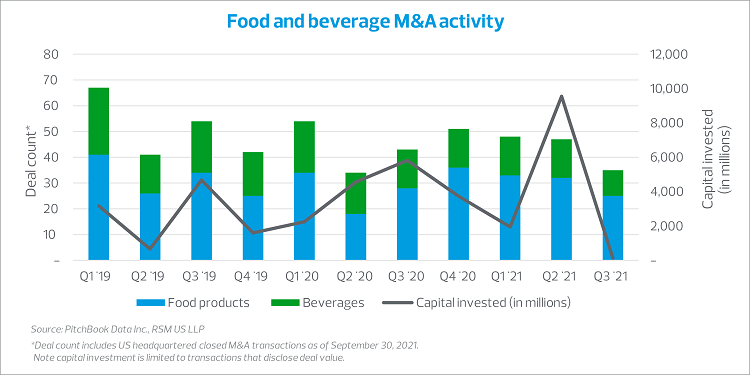

Each quarter RSM’s senior industry analysts and mergers and acquisitions professionals provide a glimpse into the consumer products deal environment. In this article, we are featuring deal activity through Q3 2021 within the food and beverage sector.

While on-trend food and beverage companies are still attractive to private equity firms and larger brands, the current M&A landscape continues to shift toward add-on acquisitions that provide additional market share or entrance into new segments. Brands preparing for sale that demonstrate strong consumer connectivity, offer health and wellness benefits, and are convenient to customers have attracted significant interest. While the uncertainty caused by the unprecedented macroeconomic landscape slowed deal activity during Q3 2021 to the lowest levels since Q2 2020, businesses that have demonstrated the ability to maintain supply and protect margins found eager buyers, particularly within the beverage sector. These companies continue to attract significant interest from potential buyers.

Note closed transactions for both food and beverage for the quarter.