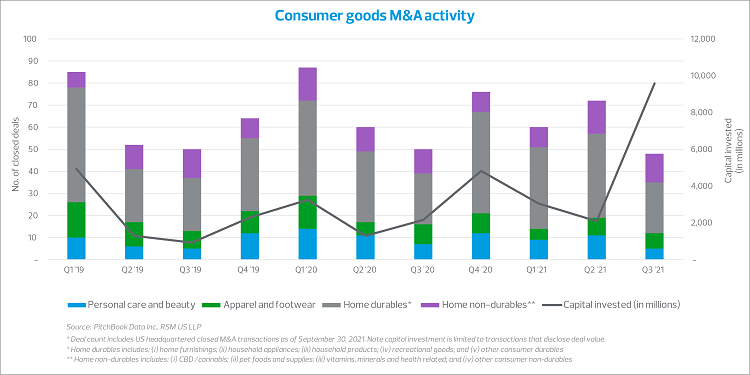

Each quarter RSM’s industry senior analysts and mergers and acquisitions professionals provide a glimpse into the consumer products deal environment. In this article, we feature deal activity through Q3 2021 within the consumer goods sector.

In 2021 consumer goods companies have faced several macroeconomic challenges affecting operations, including:

- Supply chain disruptions for materials and finished goods from abroad

- All-time high container rates on oceanic shipping

- Cost increases on raw materials

- Labor shortages and rising wage rates

As companies work to navigate these challenges, closed transactions in Q3 2021, based on information from PitchBook Data Inc., fell to the lowest level since Q2 2020, when uncertainty surrounding the COVID-19 pandemic resulted in a temporary pause in deal activity.

Businesses that completed successful transactions have demonstrated an ability to protect margins, maintain strong consumer connectivity, and expand delivery offerings to consumers through e-commerce or omnichannel platforms. Certain sub-industries—including the robust pet-product segment—are also benefiting from the transition to a hybrid work model as consumers spend discretionary dollars on home needs and renovations. The ability to sell direct to consumers is perhaps most evident in the beauty and personal care sub-segment, which continues to be a focus of strategic acquirers.