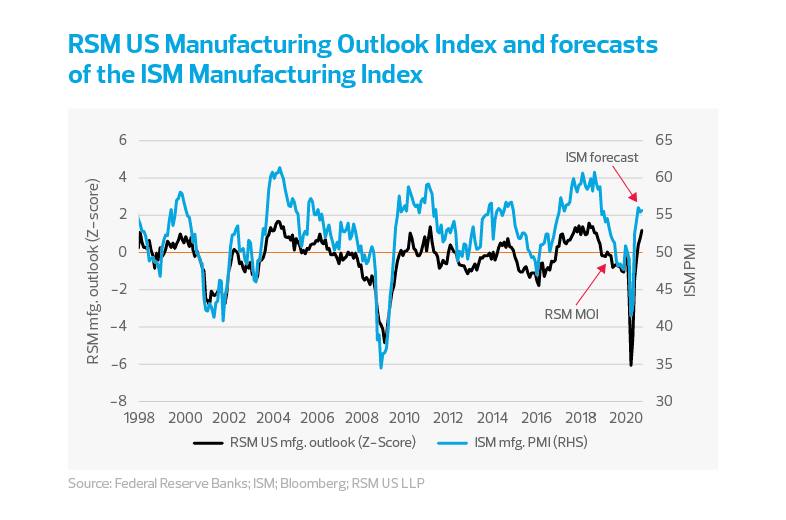

A rebound in U.S. manufacturing sentiment to the pre-trade war levels of the summer of 2018 implies that the domestic economy is moving briskly toward recovery.

For this reason, we expect that the October Institute for Supply Management manufacturing index, set to be released on Monday, will reflect a modest improvement in overall sentiment and another month of robust new orders.

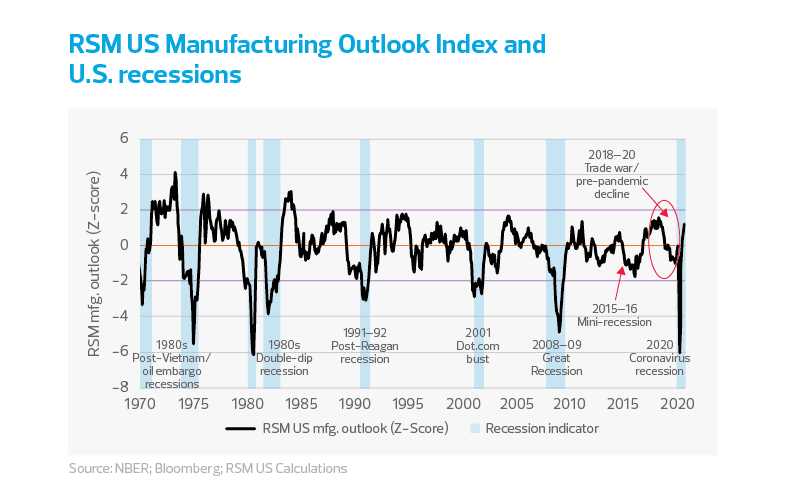

Additionally, since bottoming out in April, the RSM US Manufacturing Outlook Index has bounced back to 1.2 standard deviations above what would be expected from manufacturers’ responses to surveys conducted by the regional Federal Reserve banks.

This was the third month in a row of above-average responses to those Fed surveys and a positive sign of an economic recovery in the making. While the recent intensification of the pandemic will ultimately drive the timetable for the recovery and eventual economic expansion, we are confident that there are better days ahead for manufactures. This will be reinforced as the auto industry recovers and once Boeing solves regulatory challenges and closes the book on the 737 Max scandal.

Whether this manufacturing rebound will be sustained, however, will be determined by the health of the global community. As the United States enters the colder months, the threat of the coronavirus’ spread will undoubtedly affect consumers’ propensity to spend, which will have a negative effect on manufacturing.

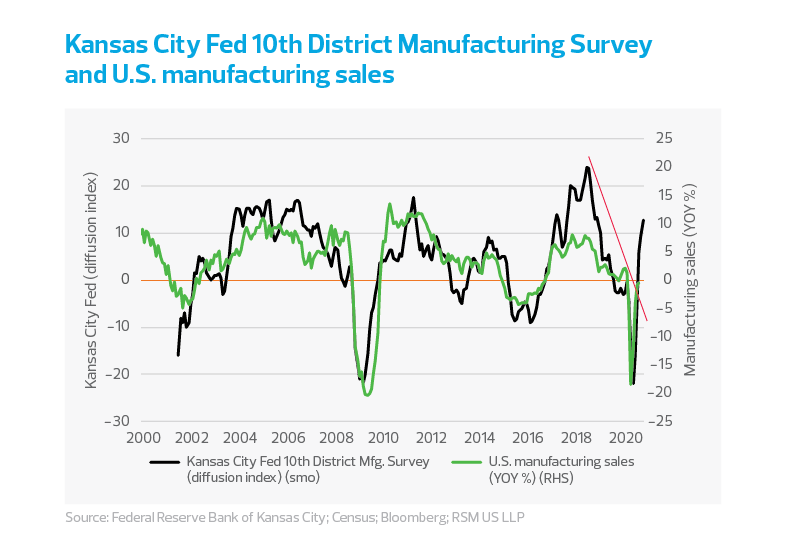

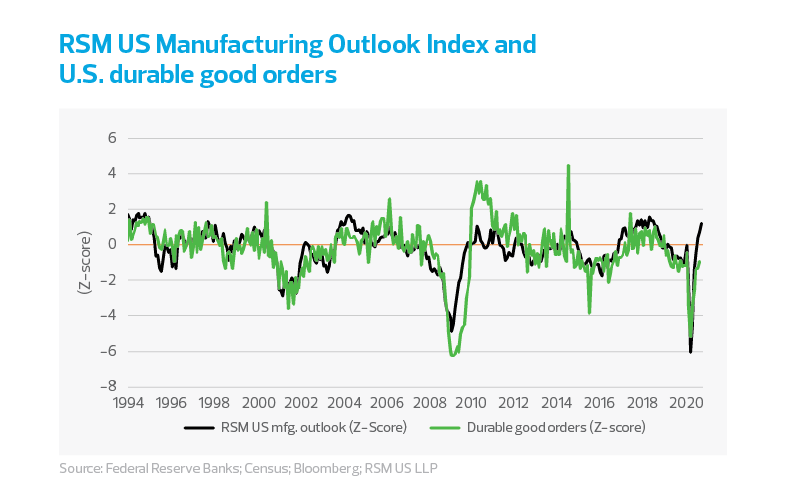

Keep in mind that industrial production’s yearly growth has been negative for 13 months in a row. And while manufacturing sales have increased since earlier this year, manufacturing sales in August (the latest available data) remain 0.4% lower than last year – not a big difference, but still a decline. And durable goods orders in September remain underwater by 0.9% relative to last year. So there is reason to maintain a cautious investment planning profile.

Interestingly, forecasts for the ISM manufacturing index are centered on a slight decrease in sentiment from its August peak. Again, the resurgence of the pandemic will most likely have an increasing impact on manufacturing sentiment.

Guide to the RSM US Manufacturing Outlook Index

Six regional Federal Reserve banks conduct monthly surveys of manufacturing activity and sentiment. We have aggregated those surveys into the composite RSM US Manufacturing Outlook Index that anticipates the direction of national manufacturing activity.

The RSM US Manufacturing Outlook Index is measured in Z-scores, which are the number of standard deviations above or below normal levels. The bank surveys are reported as diffusion indices, which vary from bank to bank (but are generally measured as positive responses minus negative responses).

The survey results are standardized relative to average sentiment during the period from 1994 to 2008, just before the Great Recession. Values of the index below two are regarded as significantly different from zero and suggest abnormal levels of stress. Values above two indicate the possibility of a bubble, which could also have negative consequences for the economy – should that bubble burst.

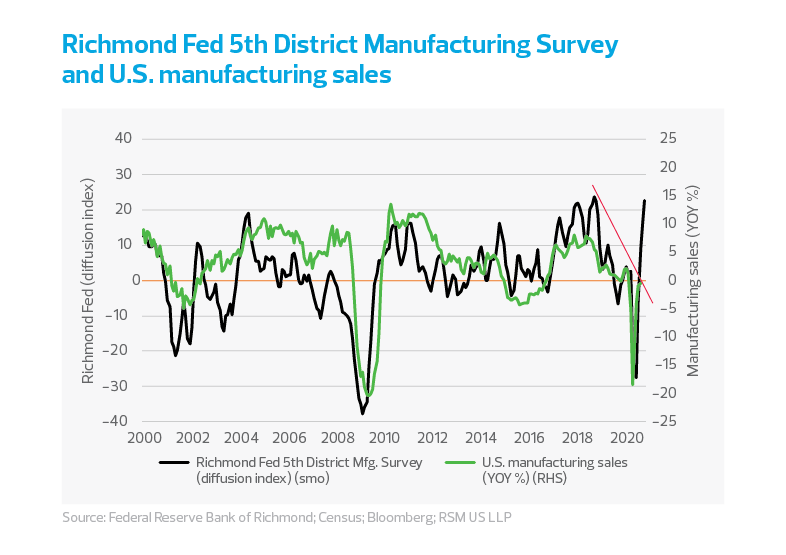

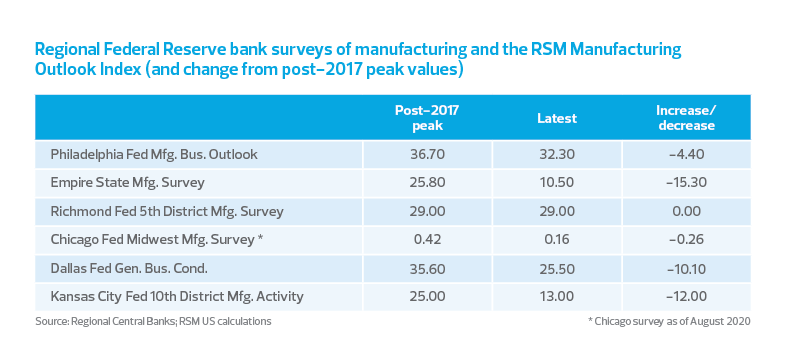

The table below shows that regional sentiment has dropped since the peaks reached before the pandemic, but have recovered above their medium-term downtrends. Manufacturing sentiment in the Richmond region shows signs of a full recovery.

Regional surveys over time

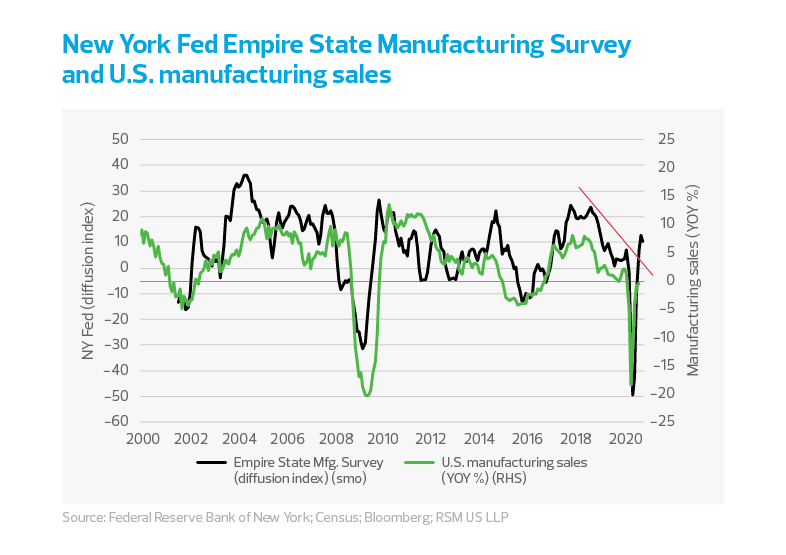

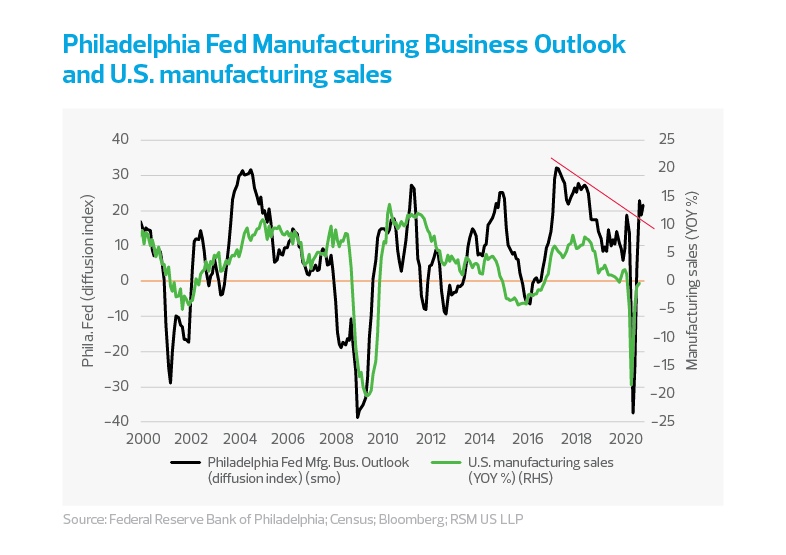

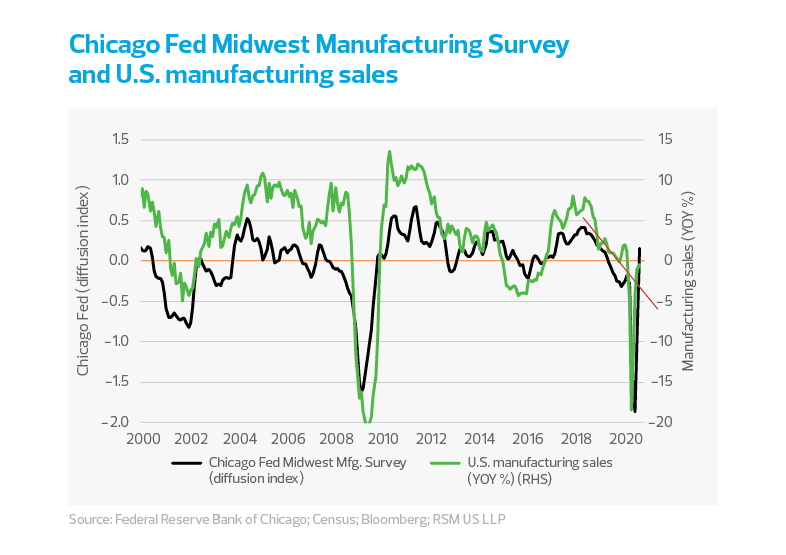

Time series for the individual surveys are included below, with the regional diffusion indices shown relative to the growth of national manufacturing sales.

Each of the surveys shows:

- A decline in manufacturing sentiment from 2017 through the present that coincides with a deceleration in manufacturing sales growth.

- An uptick in manufacturing sales at the end of 2019 and into January and February.

- A sharp drop in the surveys reported in March to May because of the coronavirus outbreak. Note that the Chicago survey is updated through August.

In the figures below, we show the three-month moving average for each of the surveys. This is done to more easily identify the underlying trend in sentiment, which has clearly broken above the 2018-20 downtrend in all regions.