The cost of drilling a new well

With oil prices so high, why haven’t U.S. producers responded with significant investments in drilling new wells?

Estimates of the breakeven cost of drilling a new well in the Permian Basin are around $50 a barrel. The implication is that at current prices, producers could conceivably flood the U.S. market with barrels of crude to be refined at U.S. facilities and sold to American consumers. But that argument ignores two important factors.

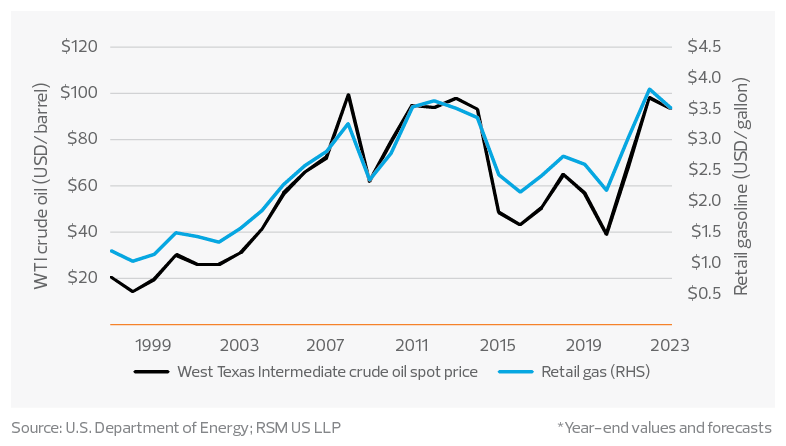

First is the financial willingness to invest in a century-old industry. The price of WTI has dropped to $40 a barrel twice in the past six years, making investors understandably wary. Who would put money down on the chance those price drops won’t occur again?

The second factor is the market-based setting for the supply-side of the pricing equation. Let’s start with the lack of excess capacity among the world’s producers, most of whom are state actors. With the exceptions of Saudi Arabia and the United Arab Emirates, most producers are already at capacity. And Russian oil is being taken out of the picture, at least for the developed economies in the West.

The Saudis and the Russians are special cases. Keep in mind that the breakeven cost for existing wells in Saudi Arabia is estimated in the range of $25 per barrel or less. But keeping prices for crude above $50 per barrel would attract competition from non-OPEC producers.

In recent decades, it was in OPEC’s best interest to keep fossil fuel prices low enough to hold on to market share and keep U.S. consumers driving inefficient vehicles.

A two-pronged approach

If anything, the recent surge in gas prices reinforces the need for a two-pronged approach to domestic energy policy.

- Don’t ignore fossil fuels: First, investment in the production of fossil fuels like natural gas, as well as oil, to bridge the long transition to renewable sources of energy will need to increase in the near term. Domestic refining capacity needs to expand as well.

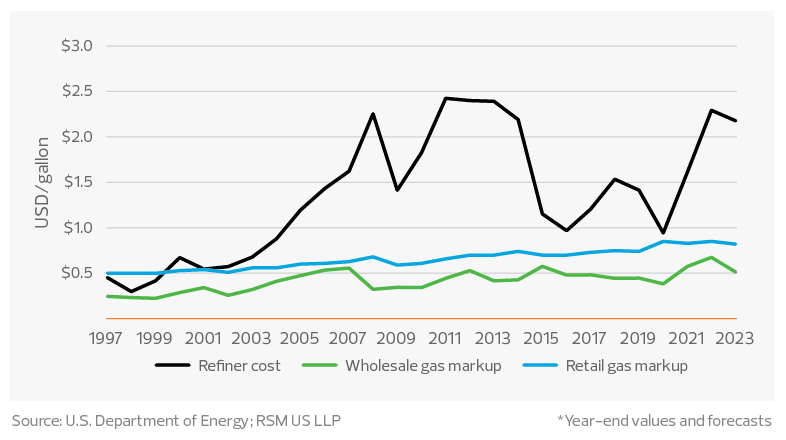

- Promote renewable energy: Second, the transition toward the development of alternative sources of energy needs to accelerate. As long as prices remain high, the incentive to invest in alternative energy sources will only increase. That is one reason why accusations of price gouging in the energy market ring hollow.

Here’s another way to think of it: If an excessive concentration of power exists inside the energy industry, prices would have increased to these levels long ago.

Moreover, prices at these levels will create the conditions for a broader increase in the supply of alternative energy sources, which will bring down demand over the medium to long term.

Price competition is a precondition for a functioning market and an increase in choices to supply energy, whether the source is oil, natural gas, nuclear, electricity, solar, wind or geothermal. Let that competition begin.

Given geopolitical tensions in Eastern Europe, Asia and the Middle East, a rational energy policy that fosters alternative sources makes every bit of sense.

The takeaway

The U.S. economy, in nominal terms, generates $24.3 trillion annually. Energy is required to sustain the general level of welfare across the economy. We can walk and chew gum at the same time. Increasing the production of fossil fuels and accelerating the transition toward renewables are not mutually exclusive goals. Widening the supply of fuels that support the economy is both necessary and wise.