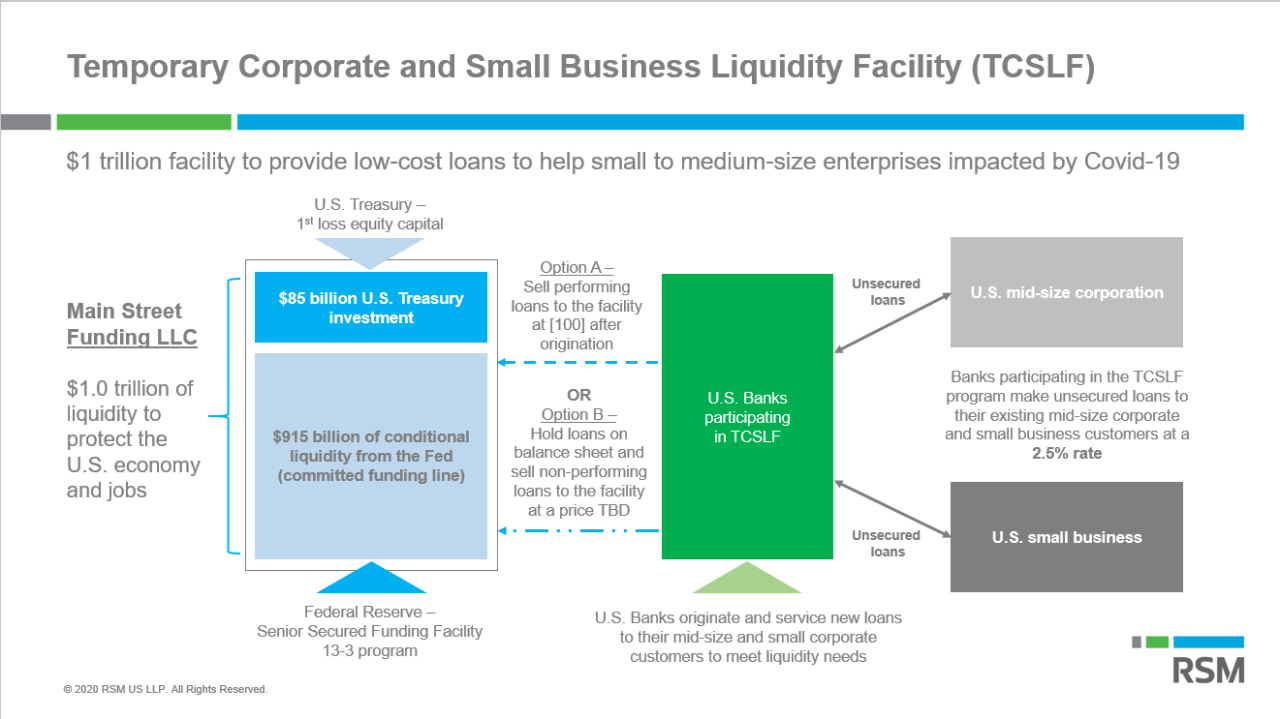

The Federal Reserve moved aggressively on Monday to mitigate what is going to be a severe disruption in the American economy by committing to an open-ended quantitative easing program and the construction of the Main Street Business Lending Program to support small and medium-sized firms.

That disruption will take the form of a depression-like set of shocks that will require a significant intervention by the federal government into economic and social life for the foreseeable future.

The Fed threw a lifeline to Main Street by announcing a significant intervention into the real economy.

This morning’s monetary and fiscal interventions are just the latest in a series of actions that are likely to continue throughout this year and likely next in response to the global public health emergency caused by the Covid-19 virus.

The Fed threw a lifeline to Main Street by announcing a significant intervention into the real economy and financial markets that intends to limit what will be a gut-wrenching increase in first-time jobless claims, unemployment, income losses and bankruptcies this year.

In addition, the policy matrix announced on Monday seeks to facilitate the flow of credit to firms and businesses to ensure that a modicum of commerce continues even as the American public is essentially being told to shelter in place until the virus can be contained.

The most important portion of the Fed’s policy action was the creation of the Main Street Business Lending Program, backstopped by Congress, to support eligible small and medium-sized businesses; it complements efforts by the Small Business Administration.