Background

According to Matthew Ball, CEO of Epyllion and angel investor, it is possible to pinpoint when a specific technology was created, tested or deployed, but identifying the onset of a new technological era is more elusive. Rather, after deployment, the technology often integrates into daily life in small ways that are not noticeable. Despite human skepticism, changes often build momentum, little by little, until it’s only apparent in hindsight that a new era has dawned.

The internet, for instance, has changed drastically since its creation in 1969. The initial network—with the acronym ARPANET—was revolutionary when several scientists combined their research, leading to the first communications from one computer to another. But it took decades of advancements and integration for a new era to truly emerge. The omnipresent connectivity of the internet is now.

Now, more than 50 years later, we are witnessing the rapid evolution of AI in real time. Amid a new technological revolution, how can we separate the true potential and use cases from hype?

Companies such as OpenAI have driven much of the popularity around the technology, and the excitement has transcended to private and public markets as businesses seek investment and other opportunities.

But some investors and consumers are wary, and skepticism goes beyond those groups. In March 2024, the U.S. Securities and Exchange Commission fined two investment advisers $400,000 for making “false and misleading statements about their purposed use of AI.”

Venture capital

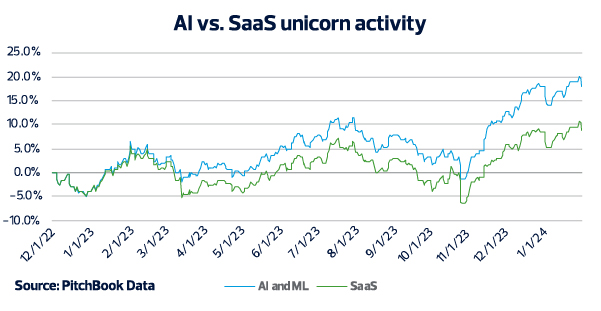

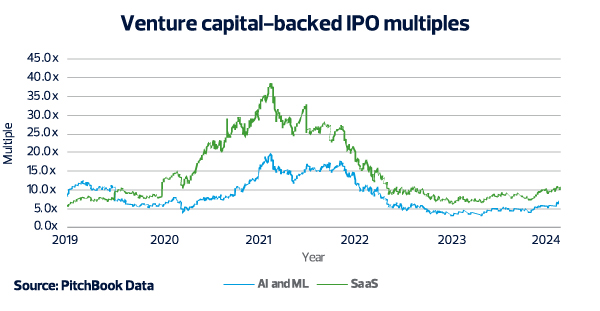

Traditionally, software-as-a-service technology has been one of the most attractive sectors for venture capital investment. However, with the advent of ChatGPT in November 2022, AI has surged to the forefront. Valuations of private companies in the AI space are currently escalating more rapidly than those in the SaaS domain, according to data from PitchBook.