Emerging fund managers face new challenges with the slowdown in investment and lending.

Key takeaways

Opportunity awaits those with deep market and sector knowledge who leverage niche strategies.

An efficient technology infrastructure is more critical than ever to tap into available capital.

After being battle-tested by COVID-19 and tightening financial conditions, real estate fund managers are now fighting a new foe: a volatile equities market that has them lamenting the denominator effect.

Public equity markets were down over 20% through September by comparison, private equity allocations took a single-digit hit. Even so, the overall downturn has caused fund allocators to hit pause on private equity investment, including real estate, until proportional values of their other strategies are rightsized; many analysts are predicting a tepid allocation to real estate investment through the second quarter of 2023.

If the public and private markets continue to show a significant gap in performance, fundraising from traditional sources will remain challenging. Adding insult to injury, large capital allocators, including pension funds and institutional investors, tend to concentrate investment toward experienced managers with proven track records during this part of the investment cycle, putting pressure on emerging managers. As a result, some new managers are relying on market fundraising through retail channels, sovereign wealth funds and other international investors—all sources that can quickly complicate tax structures and related financial reporting and compliance, adding to administrative fees.

As fundraising slows, emerging managers must adapt to maintain momentum

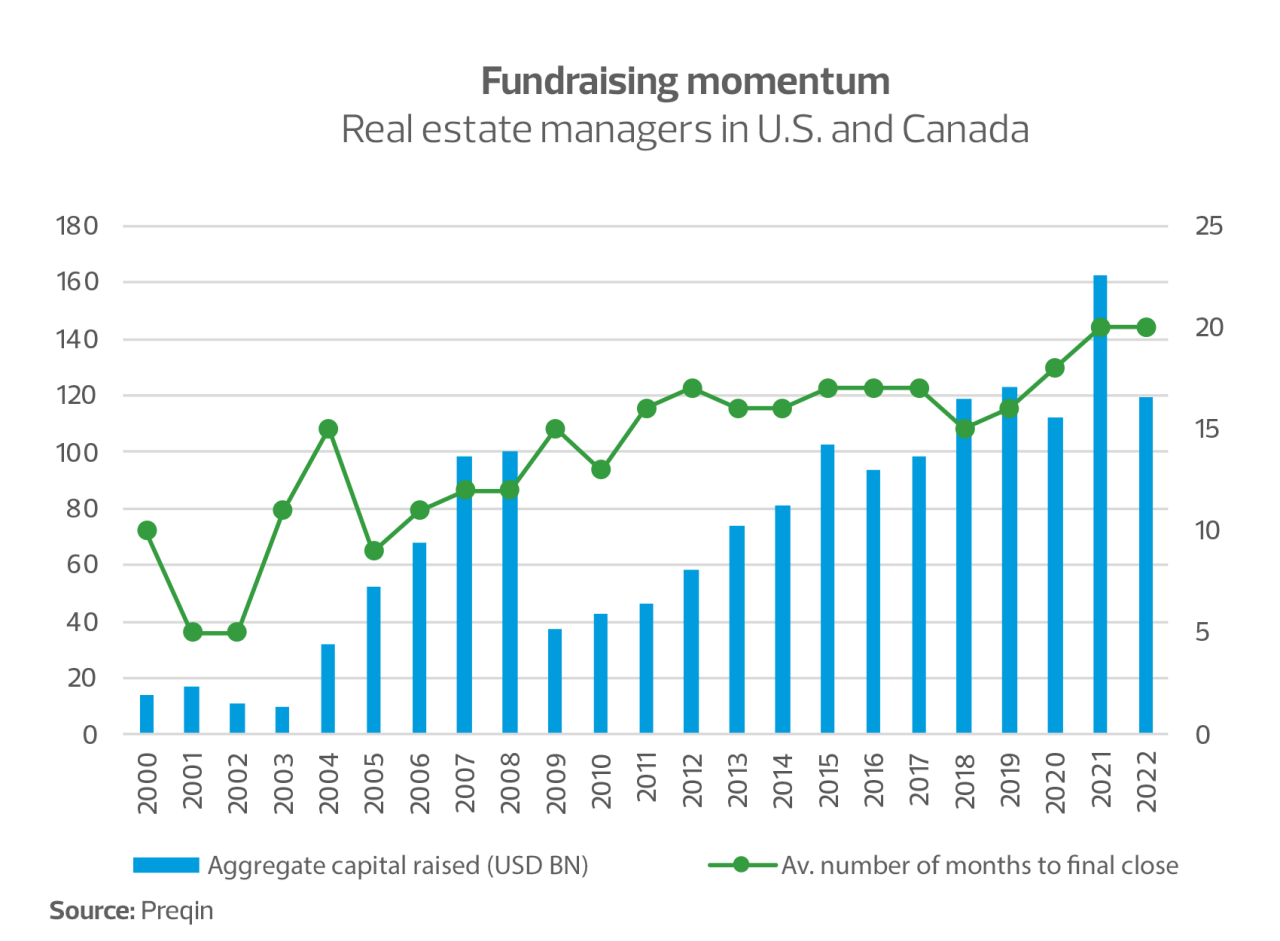

Fundraising markets have been progressively weakening. Preqin data through the second quarter of 2022 shows the amount of capital raised fell by 32% quarter on quarter, and 11% year on year. This means fund managers will face more difficulty in securing capital, and a longer time in market to close.

But for every challenge, there is an opportunity: investors with healthy balance sheets and flexible capital are poised to take advantage of the market dislocation that real estate has been waiting for since the onset of the pandemic. With the cost of financing increasing, some investors are adapting their strategies, including raising debt-focused funds to take advantage of expected tightening financial conditions. Additionally, sponsors are repositioning dry powder toward gap-lending positions created by falling loan-to-value ratios, with a heightened focus on opportunistic investments where financing has disappeared.

However, for additional leverage to be utilized (including mezzanine, preferred equity and alternative bank financing), transactions need to close. This environment dictates quality over quantity, making real-time access to underwriting data critical. Sponsors will seek assets with opportunity for strong cash flow duration to fight inflation, such as geographies with insufficient supply, vacant mixed-use industrial space, or multifamily assets where market rents and demand will outweigh inflationary pressures.

Fund managers who use niche strategies will emerge as winners

As established managers reap the benefits of a lengthy track record, differentiated, niche strategies will provide a green shoot for emerging managers. Providing a distinctive value opportunity will be critical as allocators look to place bets at this point in the cycle. Emerging managers who stay true to their core strategy will have the opportunity to showcase their deep knowledge of specific sectors or markets during this time of heightened uncertainty in underwriting future cash flows.

The life sciences sector is a prime example. This sector is mainly confined to strategic cities anchored by research institutions that draw venture capital investment and train the labor force. Facing growing competition and market saturation, investors are increasingly considering new emerging life science markets, such as Minneapolis/St. Paul, Chicago, Denver/Boulder and Salt Lake City, where barriers to entry are lower and access to R&D funding, talent and undeveloped land is plentiful. Partnership opportunities with experienced operators in these markets have opened new doors for institutional investors continuing to provide substantial returns.

Similar to life sciences, cold storage remains in high demand since online shopping has held traction following the pandemic; however, this niche sector demands costly property builds or conversions of property with necessary equipment. Location knowledge is critical to identify available properties with distribution capabilities to tap into a larger pool of customers. Underwriting for each of these asset classes requires in-depth knowledge of the cash flows and operating costs necessary.

Regardless of the sector, the advantage will go to fund managers who can provide local data, such as demographics and leasing and rent trends, to limited partners and lenders wanting more certainty before placing capital. While bringing fresh ideas and strategies is important, having an integrated and targeted technology stack will help deliver confidence and make an emerging fund manager’s core focus stand out.

The takeaway

Emerging managers face new challenges with the slowdown in investment and lending. Boots-on-the-ground market and sector knowledge will be the differentiator that bolsters investor confidence in an uncertain environment. However, with added complexity in fund structures, new layers in capital stacks and demand for real-time access to local data, an efficient technology infrastructure is more critical than ever for fund managers to tap into available capital—a task that was already daunting for new managers.

Digital transformation goes beyond the right technology. It requires the right talent, including outsourced teams with deep industry expertise and experience, efficient processes and technology solutions working together to execute on strategies and pivot quickly as the industry continues to evolve.