The U.S. private equity market in 2022 had its second-best year ever in dollar and volume terms.

Key takeaways

It was hardly the collapse that some expected given the economic headwinds.

Deal count fell 2% to an estimated 8,897 versus 9,120 in 2021, PitchBook data shows.

U.S. private equity 2022 deal flow closed on the second-best year on record in both dollar and volume terms against a backdrop of a debt-financing squeeze. Banks retreated from the broadly syndicated loan market after their balance sheets were saddled with commitments to finance leveraged buyouts on much less favorable terms earlier in the year.

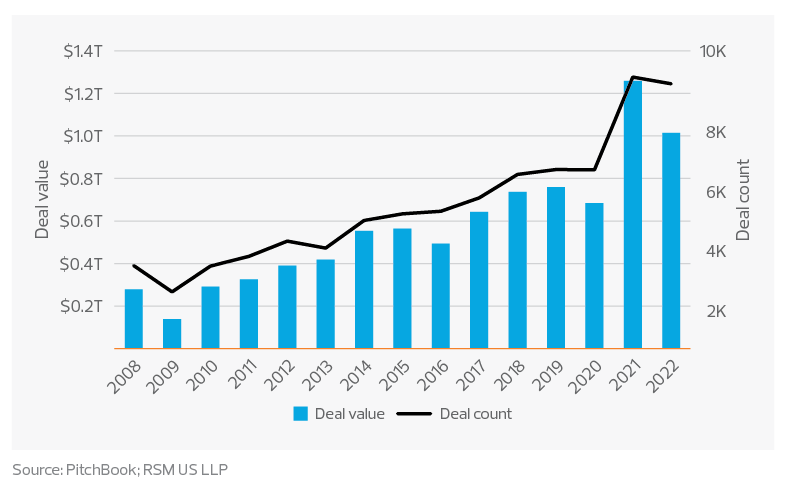

U.S. private equity deal activity

Deal activity for 2022 totaled an estimated $1.01 trillion, a decline of 19% from a record $1.26 trillion in 2021, based on data from PitchBook. Though not as epic as 2021, it’s hardly the collapse that some expected given the numerous economic headwinds. It was also the second consecutive year that deal activity exceeded a trillion dollars—a milestone that far outpaced any year other than 2021.

Deal count fell only 2% to an estimated 8,897 versus 9,120 in 2021, PitchBook data shows. By this metric, deal activity in 2022 was on as much of a tear as it was in 2021; however, the notable difference was in the size of the deals, with median buyout deal sizes reportedly dropping 12%. Nevertheless, private equity managers continued to deploy capital, albeit in smaller bets, even as inflation, rising interest rates and high energy prices raised recession fears.

Middle market insight

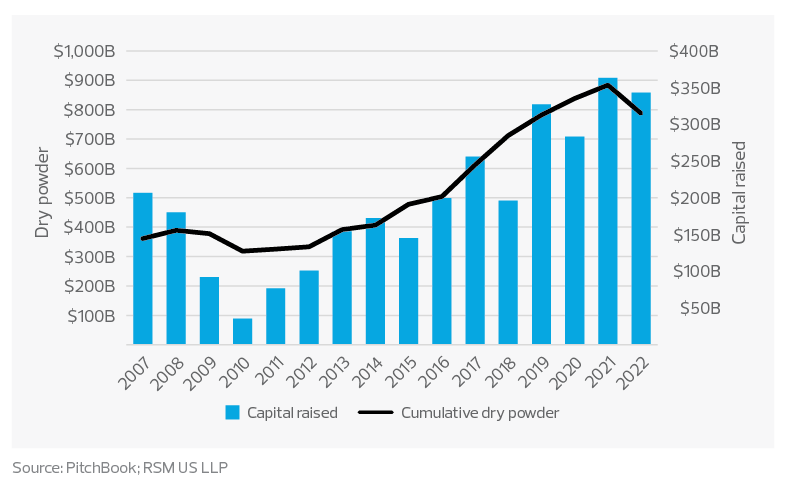

Private equity firms continue to sit on plenty of dry powder, which has kept deal-makers on the hunt; however, for the first time since 2010, cumulative dry powder recorded a drop.

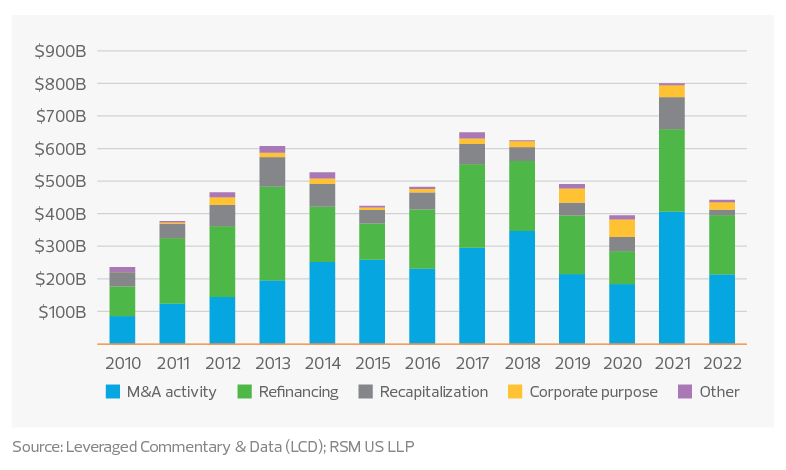

The availability of debt financing was a major inhibiting factor to large buyout deals, forcing private equity managers to focus on add-on acquisitions to keep the deal engine running. The leveraged loan market, which largely supplies the debt financing for mega buyout deals, seized up during 2022. Banks, which underwrite broadly syndicated loans on major deals, were caught in the crosshairs of rising interest rates. This left them stranded with loss-making positions that they couldn’t offset on their balance sheets.

U.S. loan issuance volume

With banks on the sidelines, private credit funds have stepped in to fill the void by increasingly financing large buyout deals, which has helped to sustain deal flow. But they can only do so much. Even with record fundraising for private credit funds in recent years, their scale still pales in comparison to the banks, forcing private equity managers to get creative about how to deploy capital.

Besides shifting to add-on acquisitions, which are smaller in size and can be more easily digested by a congested debt market, private equity managers accepted much less leverage and put down more equity on closed deals. The reduced leverage ratios and increased interest coverage ratios not only improve the chances of speedily securing the debt financing needed to close, but they also set up the portfolio companies with a much more solid footing to weather a downturn should economic conditions deteriorate.

Private equity firms continue to sit on plenty of dry powder, which has kept deal-makers on the hunt; however, for the first time since 2010, cumulative dry powder recorded a drop.

U.S. private equity fundraising and dry powder

Private equity fundraising in 2022 was relatively strong, as private equity managers went back on the fundraising trail to replenish their war chests after dipping into them extensively in the explosive dealmaking environment of 2021. But given the jittery mood in capital markets, fundraising did not keep pace with 2021 and was not enough to restore the outlays from 2021 and 2022 deal activity. Fundraising success was also skewed toward larger, more established private equity managers who enjoy more sticky relationships with institutional investors.

As institutional investors have taken significant markdowns in their public market portfolios, their private equity holdings have increased relative to their overall portfolios because of the so-called denominator effect. This has forced asset allocators to be much more selective with their allocations to private capital markets, at the detriment of emerging and lower-midsize private equity managers who struggled to get in on the fundraising action of 2022.

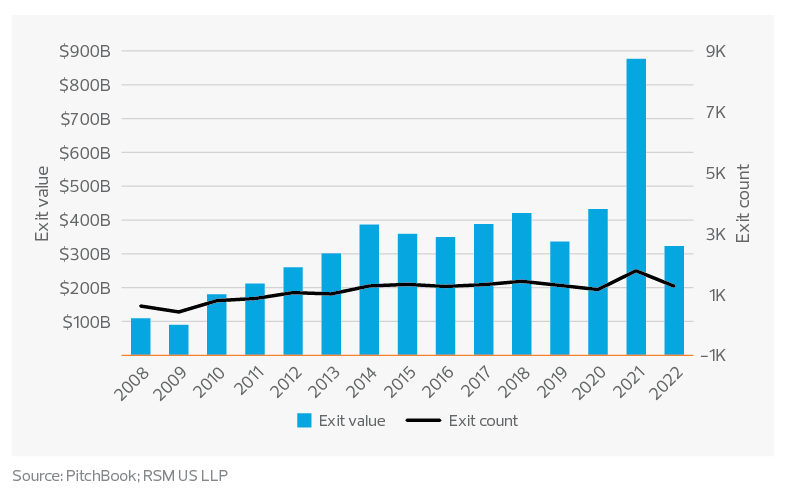

Private equity exit activity declined in 2022 to add misery to the fundraising challenges. Exit activity totaled an estimated $322.9 billion, a drop of 63% from $876.7 billion in 2021, according to PitchBook data. This means private equity managers did not realize as much in proceeds from exit transactions as in recent years, preventing them from making distributions to investors that could be recycled back to private equity funds as new commitments.

U.S. private equity exit activity

Developments to watch

Private equity faces a number of headwinds in 2023.

Benchmark interest rates are at their highest levels since the end of 2007, and the Federal Reserve is promising more hikes. This means the pain of higher borrowing costs to finance buyout transactions will persist. Portfolio companies will also feel the pinch as they struggle to keep up with higher interest burdens. Earnings to cover these interest charges will also be under threat from inflation and recession fears.

Middle market insight

The availability of debt financing was a major inhibiting factor to large buyout deals, forcing private equity managers to focus on add-on acquisitions to keep the deal engine running.

Scarcity of debt financing remains a concern with the leveraged loan market still in hiatus as the hangover effects from last year’s deal pipeline linger.

Yet it is hard to paint too dire a picture of an industry sitting on close to $800 billion in dry powder that is ready to be put to work and cannot sit on the sidelines for too long in private equity’s closed-end fund structure. The dislocation in the public markets from 2022 and re-rating of valuations from the lofty heights of 2021 can only serve to open up opportunities that can be exploited and keep appetite for deal flow alive.

We expect to see this transpire through a further proliferation in add-on deals. Private equity will also be ready to swoop in should carve-out opportunities present themselves. A number of companies have seen drops in valuation that have categorized them as mid-cap or small-cap companies and made them perfect candidates for take-private deals.

Even though financial conditions started the year in negative territory, conditions have eased from negative to neutral territory. Private equity managers will be praying conditions ease further, in hopes of reversing the negative sentiment against them that saw the stocks of major publicly traded private equity firms punished in 2022. Much of that will depend on the severity and duration of a recession, if and when it strikes.

RSM contributors

Navigate economic uncertainty with perspective and guidance from our economists and industry analysts.

Make the decisions that let your business move forward with confidence.

Q2 2024 Middle Market Business Index (MMBI)

Sentiment improves as firms look to invest

Key findings:

- The MMBI rose to 132.0 in the second quarter from 130.7 in the prior period.

- Forty percent of senior executives indicated that the economy had improved.

- A majority of executives intend to boost capital expenditures over the next six months.