This article was originally published Sept. 20, 2024, and has been updated to reflect that Republicans will control a unified government beginning in 2025.

Executive summary: Scrutiny of irrevocable grantor trusts

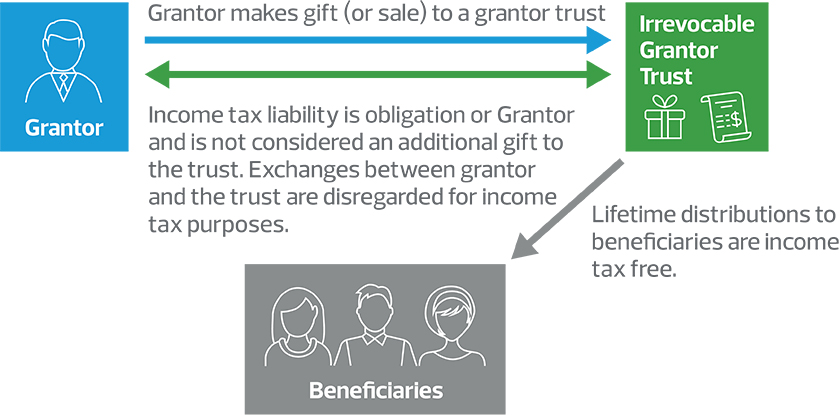

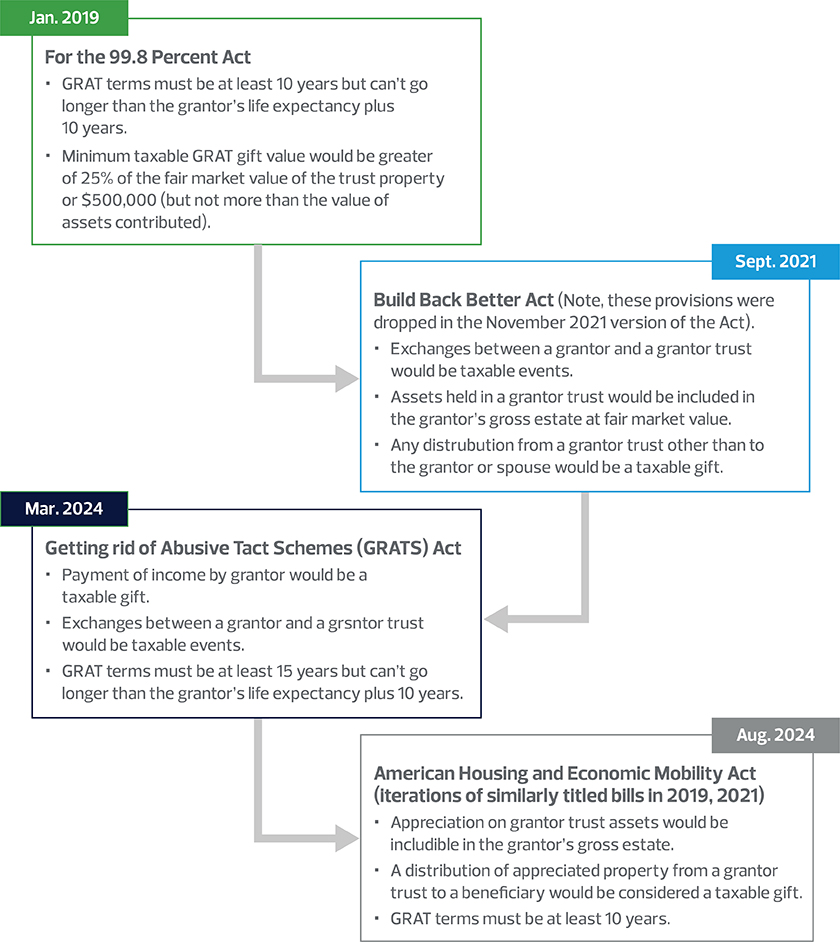

Irrevocable grantor trusts are an effective estate planning tool partly because they offer a unique combination of tax benefits. This article examines recent political scrutiny of grantor trusts and looks ahead to their future under a unified Republican government and beyond.