The leading distress indicator and catalyst for panic have been the rise in the cost of debt.

Key takeaways

Specialty servicers can provide commercial loss mitigation support to help avoid foreclosure.

Investors are implementing innovative strategies for a historically stable asset class.

Office sector distress indicators have flooded the middle market, from public real estate investment trust (REIT) valuation impairments to high-profile loan defaults, signaling that a historically stable asset class is headed toward an unfamiliar new normal.

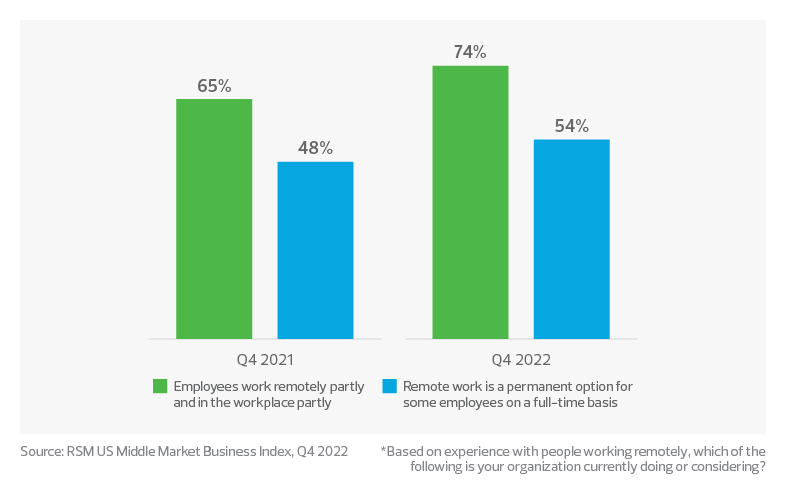

Pandemic-induced remote work arrangements have rapidly shifted from demand to oversupply. While some companies have implemented return-to-office mandates, the current workforce trend shows a steady increase in remote and hybrid work, leading to soaring vacancy levels in many metropolitan cities. According to the RSM US Middle Market Business Index Workforce Special Report, both part-time and permanent remote work options have increased for middle market companies following the height of the pandemic.

U.S. middle market work habit trends*

The expiration of historically long-term tenant leases, a decrease in lease transaction size and a movement toward favoring tenant demands are shaping investor expectations. A joint research report by CompStak and Trepp shows the average lease term and lease transaction sizes have decreased from 2019 levels, particularly for renewals and extensions, indicating a trend toward downsizing. According to the report, more than 25% of office leases executed in 2020 and 2021 will expire in the next two years.

The flight to quality has gained traction with investors as employers try to attract employees back to the office. The appeal for luxury has hurt the demand for larger office spaces in lesser-quality settings. Cushman & Wakefield’s Obsolescence Equals Opportunity Report predicts office worker density will decline to 165 square feet per employee from 190 square feet over the next eight years. This demand for Class A space puts Class B/C products at risk.

The recent disruption in the banking sector heightens the risk of distressed sales. After already facing increased difficulty in securing financing on upcoming maturities due to tighter lending conditions, office investors will no doubt be further affected by the growing uncertainty surrounding the nation’s regional and midsize banks following the collapse of several institutions. Additionally, shorter lease terms and smaller spaces will eat into the net operating income of investors, which will challenge the debt service coverage ratio requirements prescribed by lenders.

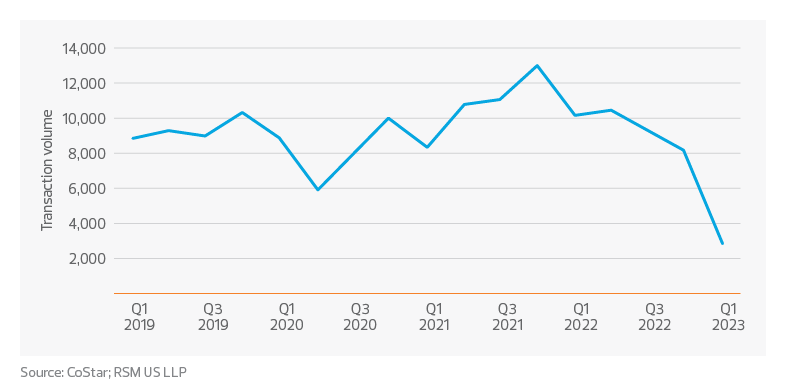

Fed rate hikes curtail office deals

The Federal Reserve’s effort to combat inflation with interest rate increases has hampered the entire real estate industry, crippling the office sector. Over the past year, the federal funds rate has risen from near zero to near 5%, a level last reached in 2007, marking the central bank’s most rapid interval of rate increases since the early 1980s. This spike has had harmful effects on the office sector, including the paralysis of transaction activity.

TAX TREND: Elevated interest rates

Relatively high interest rates, combined with an unfavorable change in tax law, have left many businesses paying more interest while seeing a decrease in their tax deductions for interest expense. As a result, real estate investors seeking to maximize their cash after taxes may be compelled to make an irrevocable election that excepts their business from the limit on the amount of business interest they can deduct from their taxable income.

U.S. office real estate transaction volume

Soft market conditions and increased capital costs have placed severe downward pressure on valuations. According to the Yardi Matrix National Office Report, an office property’s national average sale price fell to $214 per foot in the fourth quarter of 2022 from $269 per square foot in the first quarter of 2022.

Floating rate debt is a particular problem for real estate. As reported by Bloomberg, approximately 48% of debt on office properties maturing this year has a variable rate. The frequent rate reset encourages investors to supplement their loans with hedging instruments; a costly strategy in a distressed environment.

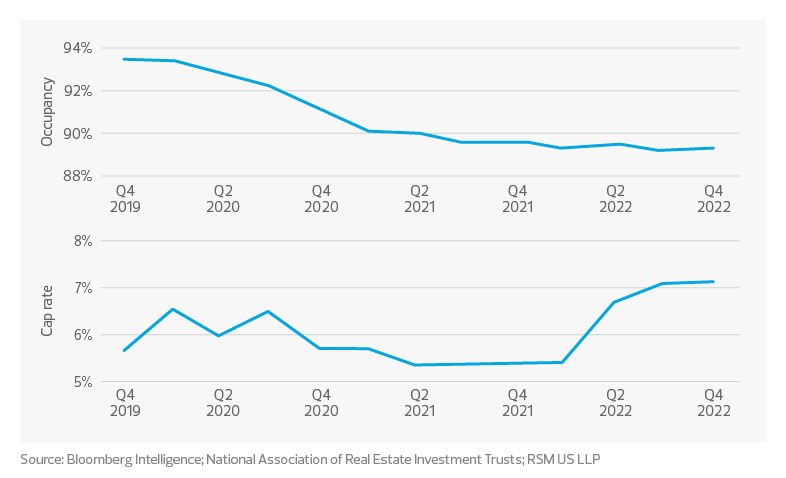

Often, trends in the public markets lead the private markets. According to recent media reports, as some investors have pulled investment out of REITs, notable investment managers have restricted such distributions. The National Association of Real Estate Investment Trusts (NAREIT) data illustrates the average office occupancy has dramatically decreased since the start of the pandemic, and at the same time, cap rates have soared amid rising interest rates and the shift to remote work.

U.S. office real estate investment trusts (REITs)

One of the most worrisome statistics is the quantity of long-term financing coming to expiration, which requires a response by lenders. Bloomberg also noted nearly $92 billion of nonbank office debt is set to mature this year, while over $40 billion is scheduled to mature by the end of 2024.

Lender response to distress

Specialty servicers oversee the resolution of mortgage loans by workout or modification of loan provisions when distressed debt descends into default and nears foreclosure. In January 2023, the office sector saw a 16-basis-point increase in the special servicing rate to 4.01%, according to Trepp, leading all asset classes in new special servicing transfers.

Most lenders are not structured to operate underlying assets and are reluctant to write down the value of their investments. In many cases, foreclosure would require the payment of transfer taxes. Additionally, most investors structure building investments as a separate financial vehicle to protect from additional recourse from creditors after a default. And at times, losing a building by foreclosure results from a decision-making pitfall known as sunk cost fallacy, which describes a hesitation to cut one’s losses.

TAX TREND: Distressed assets

Understanding the tax implications of loan defaults can inform your decisions and prevent surprises. In the case of a loan default, a borrower might have to recognize income and pay tax despite not having the cash.

Loan restructuring often involves the influx of equity in exchange for new loan terms. While investors explore alternative financing structures, including mezzanine debt or preferred equity, with higher interest rates and diminished demand, these deals have become more difficult to structure. While facing mounting office loan maturities, specialty servicers are expected to stay busy.

The takeaway

Technology investment remains essential in the office sector amid increased demand for upgraded infrastructure to improve employee comfort and productivity while reducing a building's energy consumption. Smart offices also qualify for green tax incentives and meet new standards for sustainability.

TAX TREND: Office space and ESG

As investors and developers reshape commercial office space, they commonly have an opportunity to align environmental objectives with tax benefits through the energy investment tax credit and the energy-efficient commercial buildings deduction.

Three types of building systems components qualify for the incentive:

- Interior lighting systems

- Heating, cooling, ventilation and hot water systems

- The building envelope (insulation, exterior doors, windows, roof, etc.)

These incentives allow for the potential immediate expensing of costs that a company might otherwise capitalize on and depreciate over 39 years. The deduction will be indexed for inflation beginning Jan. 1, 2023.

Investors will continue to respond to the challenges in the office sector with a focus on quality and flexible design featuring multiuse spaces such as outdoor terraces, convertible boardrooms, social gathering centers and other experience-rich amenities. According to CompStak, the average effective rent for class A buildings in 2022 was up 2.1% from 2019. Investors are also exploring alternative strategies including the conversion of office buildings to multifamily, industrial and coworking spaces, and attracting new types of tenants in the health care, life sciences and data sectors.

With evidence of office distress mounting, we expect to see continued market uncertainty as the office segment undergoes a long, evolutionary journey to rediscovery with creative investment leading the way.