In the future, we expect AI will play a larger role in helping manufacturers manage costs.

Key takeaways

Industrial companies should view AI as an enabler that can improve their business.

Digitalization will continue to be the driving force behind evolution for manufacturers.

Building more flexibility while managing costs

Manufacturers have made significant changes over the last three years as global events exposed structural vulnerabilities in just-in-time shipping and supply chain operations. Now, disruptive artificial intelligence technologies signal that another market transformation may be upon us alongside those other forces reshaping supply chains.

Companies will continue to prioritize flexible, resilient supply chains, but that flexibility brings a higher cost in the form of increased inventory, more suppliers and higher input costs. In thinking about what supply chains will look like in 2030, we expect AI will play a larger role in helping manufacturers manage such costs strategically, as will proximity to end markets and the increased presence of digitalization and automation. Global middle market manufacturers will need to invest in their supply chain capabilities with these factors in mind.

Artificial intelligence in manufacturing

AI will be both disruptive and enabling. Unlike the pandemic, however, AI is not an unthinkable or unexpected external market force, nor will its impact fade over time. Manufacturers should view AI as an enabler that can improve their business.

Implementing artificial intelligence for its own sake will not be useful for manufacturers. Any AI project should have a clear path to profitability and pay for itself in efficiencies. A rule of thumb is to start small and aim to scale up later.

The most likely use cases for AI in the industrial space will be software developed for logistics, transportation, civil engineering, construction, energy and manufacturing, according to a recent MIT Technology Review article, “Generative AI: Industrial design and engineering.” Manufacturers should consider dedicating research and development and innovation teams to monitor when software-as-a-service companies incorporate AI into new and existing software and when those technologies are expected to hit the market.

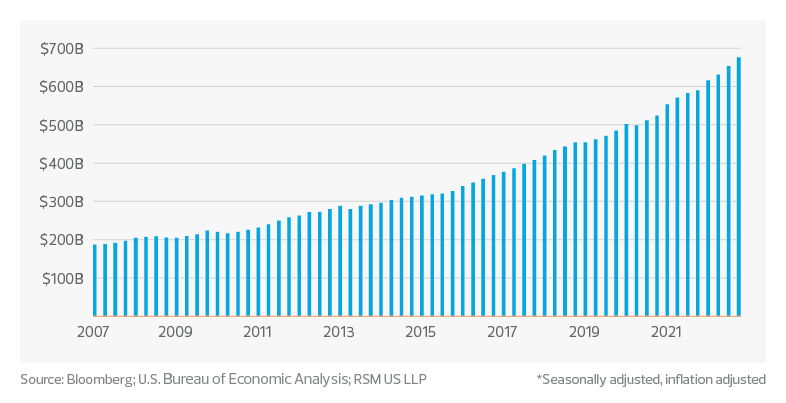

Because AI solutions will largely come in the form of software, companies’ software expenditures—already on a steep incline in recent years—will continue to grow. But AI will also help industrial businesses rapidly ideate, create prototypes, make process improvements, and analyze narrowly defined problems rapidly, all of which will help with managing costs.

U.S. software expenditures*

ChatGPT, for example, represents a significant leap in AI capabilities and provides a helpful glimpse of what is possible. The AI tool, released in November 2022, generates grammatically correct prose using training data and algorithms from user text as its input. Its output, though imperfect, will get exponentially better in the next few years. Hurdles do remain for widespread AI adoption, though. For AI to work best it will need good training data. Raw data will not produce good results on its own; a human must clean and transform large volumes of that information into usable data sets. To address this issue, we will see software companies create synthetic training data representing a problem that an AI model seeks to solve, resulting in a significant improvement in adoption rates.

But implementing AI for its own sake will not be useful for manufacturers. Any AI project should have a clear path to profitability and pay for itself in efficiencies. A rule of thumb is to start small and aim to scale up later.

TAX TREND: Supply chain

The total cost of new investments and expansions accounts for the tax implications. Statutory and negotiated incentives, along with a range of other tax considerations, should be part of the business analysis and decision-making.

Proximity to end markets

Manufacturers still need to think holistically about how they incorporate AI alongside other changes, such as making operations closer to their end markets. Recent Manufacturing Leadership Council surveys found that by 2030, 60% of manufacturers expect more nearshoring or onshoring of their operations to boost resiliency and better meet local customer needs. Indeed, U.S. foreign direct investment to and from key geographies such as China is showing signs of shifting as geopolitical tensions steer manufacturing away from the nation.

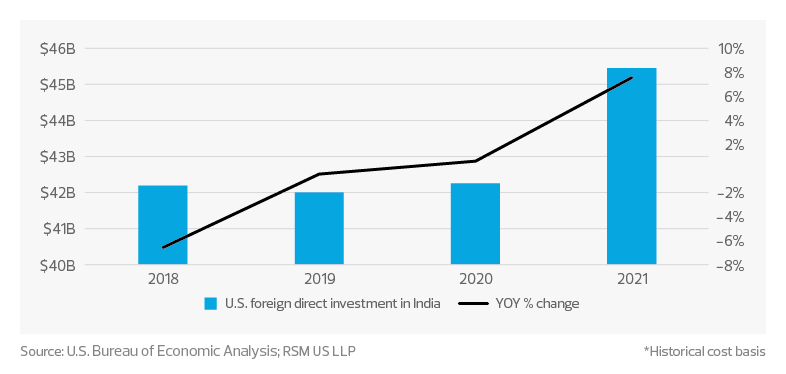

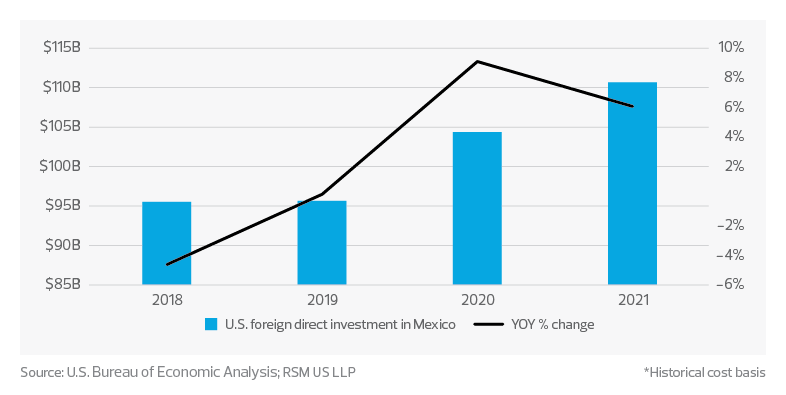

In 2021, the latest year data is available, China saw a 6% drop in FDI from the United States, according to U.S. Bureau of Economic Analysis data. During 2020 and 2021, Mexico saw a 9.1% and 6.1% increase in FDI from the United States, respectively. India saw U.S. FDI increase in 2021 by 7.6%. Both countries are positioning themselves as friendly alternatives to China.

U.S. foreign direct investment in India*

U.S. foreign direct investment in Mexico*

As 2030 approaches, we anticipate this shift toward nearshoring will accelerate. Companies that are eyeing factories in new locations should assess where there may be simultaneous opportunities to invest in automation and digitalization at those facilities.

TAX TREND: Supply chain

As supply chains evolve, the transfer pricing implications can be outsized, leading to tax planning opportunities and risk management needs. More immediately, the increasing permanence of supply chain disruptions may require companies to update their transfer pricing more frequently than in previous business cycles. A company that understands the transfer pricing life cycle can tackle the numerous complexities involved, including data management, analysis, documentation and implementation.

Special report

The middle market is embracing AI to drive innovation and efficiency

- What are the key organizational areas in which AI is making an impact?

- How are companies measuring their return on investment for AI?

- What is the future of AI for the middle market?

Digitalization in manufacturing

Digitalization will continue to be the driving force behind evolution for manufacturers across their business functions; 83.9% of executives surveyed by the Manufacturing Leadership Council expect digital adoption will accelerate in manufacturing throughout the decade. Ninety-one percent of those surveyed agree they will need to spend more on digitalizing their businesses than they currently do. Factors contributing to this trend include baby boomers retiring, lack of access to skilled and unskilled labor, and the need to increase operational productivity and capacity.

Digitalized factories provide automated real-time alerts and analytics for production, and for shop floor and warehouse performance, all of which can help manufacturers pivot in the face of those workforce challenges. Data analytics that feed dashboards with set key performance indicators can enable management to be more flexible, and e-learning and learning management systems are helping with onboarding, training and retaining new staff.

Looking ahead

The complex nature of developing a supply chain fit for 2030 will take time, patience and thoughtful investment in talent, new business infrastructure and key business processes. Manufacturers should start assessing which changes they need to make now.

TAX TREND: Supply chain

Multinational corporations reassessing their supply chains must recognize that approximately 140 countries, including the United States and other major economic powers, have agreed to implement global tax reforms in the next few years. The proposed global minimum tax and other measures to reduce tax base erosion and profit shifting could transform tax policy globally and factor into investment decisions about structuring supply chains in the future.

Companies that understand the reforms can account for potential after-tax costs when investing in supply chain resilience and be more flexible in their supply chain strategy as legislative processes continue.