Notice 2003-65 has provided loss corporations with clear and taxpayer-favorable guidance.

Key Takeaways

Proposed section 382 regulations would impose a large de facto tax for corporations with loss carryforwards.

The Treasury is reconsidering the proposed regulations and may issue revised and more taxpayer-favorable regulations.

This content was originally published in AIRA Journal, Volume 34 No. 4. Reprinted with permission

Congress enacted “new” section 382 as part of the Tax Reform Act of 1986 to provide a comprehensive system to prevent trafficking in NOLs.1,2 This code section was designed to make a buyer economically indifferent to acquiring a corporation with or without NOLs. Under highly complex rules, this goal was partially accomplished by limiting the utilization of NOLs to the value of the corporation immediately before a section 382 ownership change3 (and subject to certain adjustments), multiplied by a prescribed long-term tax-exempt rate4 (the base limitation).5 An acquirer would thus be able to use net operating losses at approximately the same rate as if they had invested the same amount of money in long-term tax-exempt bonds. The calculation of this component of the section 382 limitation has been relatively straightforward and uncontroversial.

SECTION 382(H) – BUILT-IN GAINS AND LOSSES

In addition to the base limitation, section 382 also takes into account certain built-in items to increase or effectively decrease the annual base limitation. Unlike the base limitation, the calculation of built-in items has been the subject of considerable debate and uncertainty.

As an example of a built-in item, assume immediately before the ownership change the loss corporation had an asset with a fair market value of $100 and an adjusted basis of $0. If the corporation had sold the asset before the ownership change, the NOL on the ownership change would have been $100 lower (i.e., the pre-existing NOLs would be available to offset that income without limitation). To recognize how this pre-change sale could impact NOLs subject to limitation, Congress enacted section 382(h). Generally, section 382(h) provides that if the asset is sold within a prescribed 5-year recognition period after an ownership change, the section 382 limitation may be increased by an amount up to the $100 recognized built-in gain.6 Similarly, if the loss corporation had an asset with an adjusted basis of $100 but a FMV of $0, the sale of such asset during the five-year recognition may be treated as a recognized built-in loss – and then treated as a pre-change loss subject to the section 382 limitation.7

In order to assess the impact section 382(h) has on the loss company’s section 382 limitation on an ownership change date, the loss corporation compares the FMV of all its assets to the adjusted tax basis in such assets existing immediately before the ownership change. If the FMV of the assets exceeds the aggregate adjusted basis in the assets in excess of the threshold amount (discussed below), then the loss corporation is in a net unrealized built-in gain (NUBIG) position.8

Alternatively, if the aggregate adjusted basis in the assets exceeds the FMV by the threshold amount, then the loss corporation is in a net unrealized built-in loss (NUBIL) position.9 If the difference is lower than the lesser of $10 million or 15% of the FMV of the assets before the ownership change (the threshold amount), then the corporation is in neither a NUBIG or NUBIL.10

For a company in a NUBIG position immediately before the ownership change, only recognized built-in gains (RBIGs) during the section 382(h)(7)(A) five-year recognition period would increase the section 382 limitation.11 Similarly, for a loss corporation in a NUBIL position immediately before the ownership change, only recognized built-in losses (RBILs) during the five-year recognition period would be treated as pre-change losses.12

The definition of RBIG and RBIL also includes certain items of “built-in” income or loss. Any item of income that is properly taken into account during the recognition period but which is attributable to periods before the change date shall be treated as RBIG for the taxable year in which it is properly taken into account (built-in income).13 Contrarily, any amount which is allowable as a deduction during the recognition period (determined without regard to any carryover) but which is attributable to periods before the change date shall be treated as RBIL for the taxable year for which it is allowable as a deduction (built-in loss).14

One item of built-in income that could give rise to RBIG is the cancellation of indebtedness income (COD income). As described later, the inclusion of COD income in NUBIG/NUBIL calculations, as well as treating COD income as RBIG, has been a complex issue for which guidance from the government has changed over time.

The calculation of RBIGs (or RBILs), in general, has presented many practical issues for both taxpayers and the government. Section 382(h)(2) places the burden on a loss corporation in a NUBIG to establish that any gain recognized is RBIG (and conversely, that any loss recognized by a loss corporation in a NUBIL is not RBIL).

Assume a taxpayer sells an asset three years after an ownership change for a $100 gain (and the taxpayer was in a NUBIG position on the ownership change date). To determine if any or all of the $100 gain was RBIG, the taxpayer would have been required to determine the adjusted tax basis and FMV for that asset on the ownership change date. Then assume the taxpayer has tens of thousands of assets and perhaps has experienced multiple section 382 ownership changes. The practical challenge of this requirement to appraise and trace strained the ability of taxpayers to calculate and for the IRS to audit.

NOTICE 2003-65

In order to address the logistical issues described above, the Treasury issued Notice 2003-65, 2003-2 C.B. 747 (the Notice), which provides two safe harbors to calculate the recognition of built-in gains and losses, the 1374 approach and the 338 approach.

The 1374 approach

The 1374 approach is generally favorable to taxpayers in a NUBIL position. The Notice provides:

In cases other than sales and exchanges, the 1374 approach generally relies on the accrual method of accounting to identify income or deduction items as RBIG or RBIL, respectively. Under this approach, items of income or deduction properly included in income or allowed as a deduction during the recognition period are considered “attributable to periods before the change date” under sections 382(h)(6)(A) and (B) and, thus, are treated as RBIG or RBIL, respectively, if an accrual method taxpayer would have included the item in income or been allowed a deduction for the item before the change date.15

As such, only those items that an accrual method taxpayer would have been allowed as a deduction before the ownership change would be treated as RBIL under the 1374 approach. Moreover, the 1374 approach only allows for a benefit for taxpayers in a NUBIG position if the asset is actually disposed during the recognition period.

With respect to COD income, the Notice provides:

The 1374 approach generally treats as RBIG or RBIL any income or deduction item properly taken into account during the first 12 months of the recognition period as discharge of indebtedness income (COD income) that is included in gross income pursuant to section 61(a)(12) or as a bad debt deduction under section 166 if the item arises from a debt owed by or to the loss corporation at the beginning of the recognition period. However, the reduction of tax basis does not affect the loss corporation’s NUBIG or NUBIL under section 382(h)(3).

Example 8. LossCo has a NUBIG of $300,000. On the change date, LossCo has an asset with a fair market value of $200,000 and a basis of $150,000. The asset is subject to a debt with an adjusted issue price of $98,000. During Year 1 of the recognition period, LossCo satisfies the debt by paying the lender $95,000. On its tax return for Year 1, LossCo includes in gross income $3,000 of COD income. That amount is RBIG in Year 1. In Year 2, LossCo sells the asset for $200,000. The $50,000 of gain recognized on the sale of the asset is RBIG in Year 2.

Example 9. The facts are the same as in Example 8, except that $3,000 of the debt is discharged in a Title 11 case. LossCo excludes the $3,000 of COD income under section 108(a) and reduces the tax basis of the asset from $150,000 to $147,000 under sections 108(b)(5) and 1017(a). The $3,000 of COD income that is excluded from income is not treated as RBIG. However, because the basis reduction is treated as having occurred immediately before the recognition period for purposes of section 382(h)(2), the $53,000 of gain recognized on the sale of the asset is RBIG.16

The 338 approach

The 338 approach is generally favorable to taxpayers in a NUBIG position. The Notice provides:

The 338 approach identifies items of RBIG and RBIL generally by comparing the loss corporation’s actual items of income, gain, deduction, and loss with those that would have resulted if a section 338 election had been made with respect to a hypothetical purchase of all of the outstanding stock of the loss corporation on the change date (the hypothetical purchase). As a result, unlike under the 1374 approach, under the 338 approach, built-in gain assets may be treated as generating RBIG even if they are not disposed of at a gain during the recognition period, and deductions for liabilities, in particular contingent liabilities, that exist on the change date may be treated as RBIL.

This ability to generate RBIGs from “wasting assets” (i.e., for assets that were not actually disposed during the 5-year recognition period) is the most taxpayer beneficial feature of the 338 approach.17

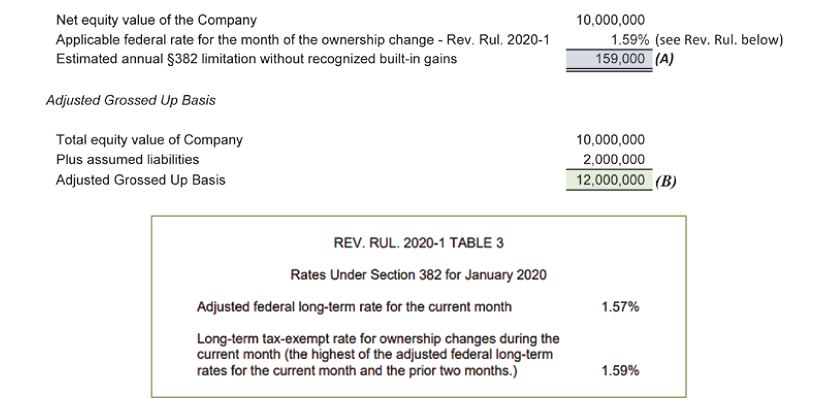

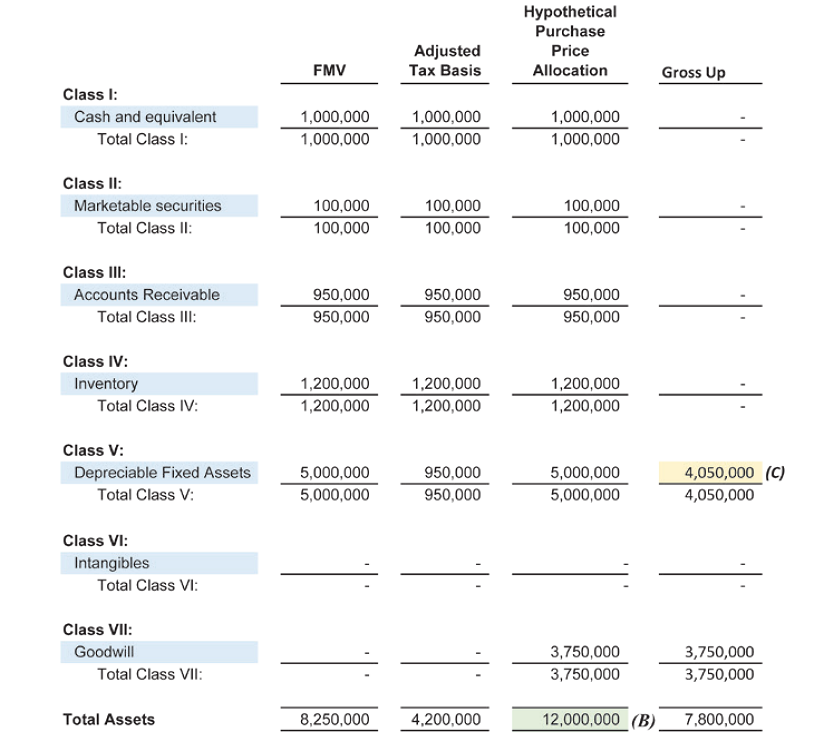

Below (Exhibits 1, 2, and 3) is a simplified case study to illustrate the 338 approach for a hypothetical ownership change occurring on Jan. 1, 2020. In this example, no assets are actually sold and there are no items of built-in income. Instead, all of the RBIGs are generated from the hypothetical step-up of wasting assets (in this case, fixed assets and goodwill).

Exhibit 1: 338 Approach – A Simplified Case Study

Exhibit 2: 338 Approach Case Study, Cont. – Hypothetical Section 338 Step-Up18,19

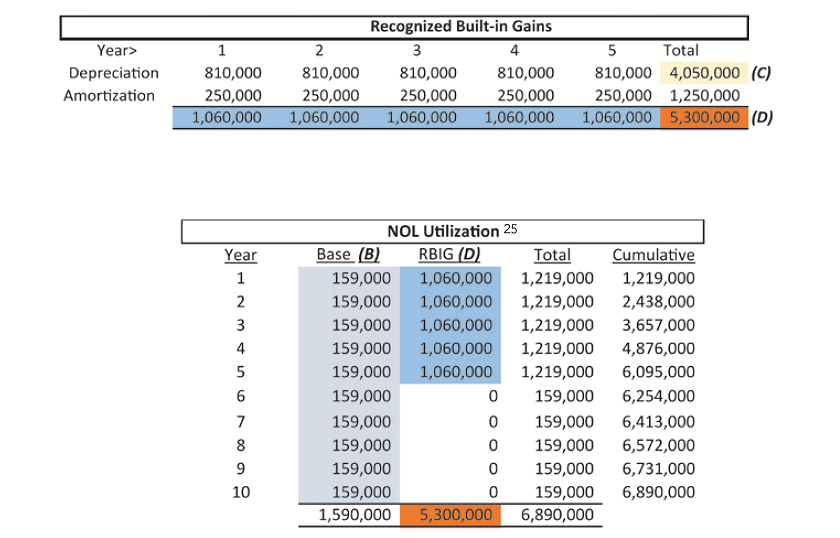

Note in Exhibit 3 that the base limitation is often quite low compared to the RBIG. As the RBIG is recognized in the first five years after the ownership change, the NPV of NOL utilization in the first five years can thus be relatively high, while the NPV of NOL utilization after the first five years is generally low.

Exhibit 3: 338 Approach Case Study, Cont. – Recognized Built-in Gains

With respect to COD income, the proposed regulations generally would not allow COD income to be included in the calculation of NUBIG/NUBIL but would provide certain exceptions. One major exception is that all includable COD income of the loss corporation that is recognized on recourse debt during the 12-month period following the change date would be eligible for inclusion in the NUBIG/NUBIL computation.20

In addition, the proposed regulations provide limitations relating to the extent excluded COD income is treated as RBIG. The proposed regulations also provide that COD income recognized during the post-change period generally would not be treated as RBIG. However, these proposed regulations would provide taxpayers with the option to treat certain COD income recognized during the first 12 months of the recognition period as RBIG (and consequently to make corresponding adjustments to the taxpayer’s NUBIG/NUBIL computation as described above).21

Transition guidance

On Jan. 10, 2020, the Treasury and IRS proposed transition guidance (transitional guidance) relating to the proposed regulations issued on Sept. 9, 2019. This transitional guidance provides that the final regulations (if and when actually issued) would generally be applicable thirty days after publication of the final regulations in the Federal Register (the applicability date). Exceptions to this rule include ownership changes that occur pursuant to an order of a court (or pursuant to a plan confirmed, or a sale approved, by order of a court) in a title 11 or similar case provided that the taxpayer was a debtor in a case before such court on or before the applicability date.

The proposed transition guidance also provide that taxpayers may retroactively apply the provision in proposed regulation section 1.382-7(d)(5) that certain carryforwards of business interest expense disallowed under section 163(j) would not be treated as recognized built-in losses under section 382(h)(6)(B) if such amounts were allowable as deductions during the five-year recognition period.

Summary

The first component of the section 382 limitation, the “base” limitation, has been relatively uncontroversial.

In contrast, the second component of the section 382 limitation, the calculation of RBIG or RBIL, has been the subject of considerable uncertainty and debate. As noted above, the RBIG component to the section 382 limitation may dwarf the base limitation, especially given low prevailing interest rates.

While section 382(m) instructs the Treasury to prescribe regulations to carry out the purposes of sections 382 and 383, no final regulation have been issued for section 382(h), relating to the calculation of NUBIG/NUBIL and RBIG/RBIL.

Notice 2003-65 offered both taxpayers and the government much-needed clarity and guidance regarding the application of section 382(h).

The proposed regulations have been heavily criticized and would impose a de facto large tax increase, in particular, on modern life science and technology corporations who would generally not generate RBIGs through the disposition of built-in gain assets.

Moreover, for distressed companies, including those exiting bankruptcy pursuant to section 382(l)(6),22 the limitations on the treatment of COD income as NUBIG/ RBIG would similarly reduce the value of their loss carryforwards following such COD transactions.

As the proposed regulations were issued over two years ago, it is difficult to predict in what form, if any, they may be adopted in temporary or final form. “The preamble to the transitional guidance implies that Treasury and the IRS understand the controversial nature of their proposal and could suggest a more balanced set of rules is under development. Because the built-in gain rules of section 382 are both complicated and changing, taxpayers should consult a tax adviser when considering transactions that may implicate these rules.”

Companies in the life science and technology arena are often in a NUBIG position, as most of their value is derived from self-created intangibles with little or no tax basis. Per the section 382(h)(7)(A) prescribed 5-year recognition period, the RBIG for such corporations with few fixed assets would generally reflect the amortization of intangibles and goodwill for only five years of the 15-year life for such hypothetical section 197 assets. To the extent that a company has shorter-lived assets, such as traditional manufacturing companies with substantial fixed assets, the RBIG may be comparatively higher as more of the NUBIG might be recognized in thefive5-year recognition period.

Under the 338 approach, built-in income items are also favorably treated. For example, COD income that is included in gross income under section 61(a)(12) and that is attributable to any pre-change debt of the loss corporation is RBIG in an amount not exceeding the excess, if any, of the adjusted issue price of the discharged debt over the fair market value of the debt on the change date.23

PROPOSED REGULATIONS

On September 9, 2019, the Treasury and the IRS released proposed regulations (the proposed regulations) that withdraw and obsolete Notice 2003-65. These proposed regulations would completely eliminate the section 338 approach.24 In the example above, NOL utilization would be limited to the $159,000 annual base limitation, plus any actual sales of built-in gain assets and built-in income items. The $5.3 million of RBIG calculated under the 338 approach, in that example, would thus be eliminated by the proposed regulations, rendering the NPV of pre-change losses close to nil.

The proposed regulations would require the use of the 1374 approach, but with taxpayer unfavorable modifications. The proposed regulations “would significantly modify the 1374 approach set forth in Notice 2003-65 to include as RBIL the amount of any deductible contingent liabilities paid or accrued during the recognition period, to the extent of the estimated value of those liabilities on the change date.”25 Under the 1374 approach in Notice 2003-65, contingent liabilities are included in the calculation of NUBIG/NUBIL but are not treated as RBILs.

As such, for taxpayers in a NUBIL position, the proposed regulations retain the 1374 approach, modified to increase RBILs. For taxpayers in a NUBIG position, the proposed regulations eliminate all RBIGs except for actual sales of built-in gains and built-in income. The regulations are thus unfavorable to taxpayers in both NUBIG and NUBIL positions.

[1] See H.R. Rep. No. 426, 99th Cong., 1st Sess. 256 (1985). See also, S. Rep. No. 313, 99th Cong., 2nd Sess. 232 (1986).

[2] Sections 382 and 383 currently limit utilization of net operating losses, capital losses, R&D and GBC credits, section 163(j) and other carryforwards. References to NOLs encompass all attributes subject to limitation. A “loss corporation” is a C corporation with any such attribute carryforward(s) which makes it subject to the section 382 rules.

[3] In very general terms, under Byzantine and labyrinthine rules, a section 382 ownership change occurs when there is more than a 50% change in ownership of a loss corporation (by value) over a prescribed “testing period.” Section 382(g) (1). A “testing period” is a three-year rolling period, and is shorter when there has been a prior ownership change in the prior three years, or the company has not been a loss corporation for three years. Section 382(i).

[4] Section 382(b). Every month, the Treasury issues a Revenue Ruling that includes the “applicable federal rate” for section 382 ownership changes occurring during that month.

[5] Note in the case of multiple ownership changes, NOLs are available based on the most restrictive limitation to which the NOLs are subject. In a simple example, $100 of NOLs generated as of 12.31.X1 are subject to limitation of $10 / year. $120 of NOLs generated as of 12.31.X2 are subject to limitation of $8 / year. In that case, all NOLs are essentially subject to the $8 / year limitation (the most restrictive limitation). If the $120 of NOLs subject to the 12.31.X2 limitation alternatively have a limitation of $12 / year, then the $100 of NOLs subject to the 12.31.X1 limitation would be subject to the prior $10 / year limitation, and the $20 of NOLs generated between 12.31.X1 and 12.31.X2 would have a $12 / year limitation. However, as of 12.31.X3, while $20 of NOLs subject to the 12.31.X1 limitation would have freed up, they are still subject to the $12 / year 12.31.X2 limitation. As such, only $12 of NOLs would be available as of 12.31.X3 (the most restrictive limitation).

[6] Section 382(h)(2)(A).

[7] Section 382(h)(2)(B).

[8] Section 382(h)(3)(A).

[9] Id.

[10] Under section 382(h)(3)(B), if a loss corporation’s NUBIG or NUBIL does not exceed a threshold amount (the lesser of $10,000,000 or 15% of the fair market value of its assets immediately before the ownership change), the loss corporation’s NUBIG or NUBIL is zero. Thus, a loss corporation cannot have both a NUBIG and a NUBIL, but it can have neither.” Notice 2003-65, 2003-2 C.B. 747, page 4.

[11] Section 382(h)(1)(A).

[12] Section 382(h)(1)(B).

[13] Section 382(h)(6)(A).

[14] Section 382(h)(6)(B).

[15] Notice 2003-65, page 8.

[16] Notice 2003-65, pages 10, 11.

[17] Prior to the issuance of Notice 2003-65, the Treasury Department and the IRS issued Notice 87-79 (1987-2 C.B. 387) and Notice 90-29 (1990-1 C.B. 336), which provided much more limited guidance regarding the determination of built-in gains and losses.” Preamble to proposed regulation sections 1.382-2 and 1.382-7.

[18] In this example, the hypothetical fixed asset reflects an alternative deprecation system (“ADS”) straight-line life of 5 years. Under the 338 approach, the fixed assets would be depreciated under whatever method (and lives) the taxpayer is actually using (which could be MACRS or ADS). Notice 2018-30, 2018–17 I.R.B. 508, provides that bonus depreciation may not be taken in computing the section 338 approach.

[19] Note that intangibles and goodwill are amortized over a 15-year straight- line period. As the section 382(h)(7)(A) RBIG recognition period is only 5 years, only 5/15ths (or 1/3rd) of the hypothetical intangible/goodwill asset creates RBIG, as discussed above.

[20] Id.

[21] Id.

[22] Section 382 provides two bankruptcy exceptions. Under section 382(l)(5), if certain conditions are met, there is no section 382 ownership change upon emergence from a title 11 or similar case, but certain interest deductions paid to creditors who become shareholders are eliminated from the post-emergence NOL. Under section 382(l)(6), an ownership change occurs, but the limitation is based on the value of the corporation after taking into account any surrender or cancellation of creditors’ claims in a title 11 or similar case.

[23] Notice 2003-65, page 17.

[24] the Treasury Department and the IRS have concluded that the 338 approach lacks sufficient grounding in the statutory text of section 382(h). Further, the Treasury Department and the IRS have determined that the mechanics underlying the 338 approach (i) are inherently more complex than the accrual-based 1374 approach, (ii) can result in overstatements of RBIG and RBIL, and (iii) as a result of the TCJA, would require substantial modifications to eliminate increased uncertainty and ensure appropriate results.” Preamble to proposed regulation sections 1.382-2 and 1.382-7. These assertions have been heavily criticized by commentators.

[25] Preamble to proposed regulation sections 1.382-2 and 1.382-7.