Over the past 18 months, builders have struggled to produce enough homes to meet record demand.

Key takeaways

The housing market remains on solid foundation amid a shortage of homes and growing rates of new households.

The cooling in demand has caused builders to slow construction activity.

The housing market has been on a wild ride since the onset of the pandemic in early 2020. Demand temporarily plummeted in March of that year, followed by a quick rebound amid changing consumer preferences led by remote work and a renewed emphasis on domestic spaces. Despite rapid appreciation in home prices, historically low interest rates kept mortgage payments affordable for homebuyers, fueling the market.

Now, with inflation recently exceeding 9%, the Federal Reserve has moved to cool the economy with a series of aggressive interest rate hikes. As a result, 30-year mortgage rates were hovering close to 6% in July, over two percentage points higher than the beginning of the year. Expensive mortgages, combined with record appreciation of homes, has made affordability a stretch for many, causing potential buyers to pull back.

Affordability, as measured by the National Association of Realtors Housing Affordability Index, plummeted to 102.8 in the second quarter, compared to 147.7 the same time last year. For first-time buyers, the number was even more concerning at 68, compared to 97.3 a year earlier. A value of 100 means that a family with the median U.S. income is earning exactly enough to qualify for a mortgage on a median-priced home, assuming a 20% down payment.

Despite rising costs, in our opinion housing is not headed for a crash. While we expect to see sharp deceleration of appreciation in home values in the second half of the year, as well as some price corrections, the housing market remains on solid foundation, given the long-term housing shortage and growing rate of household formations.

The housing shortage

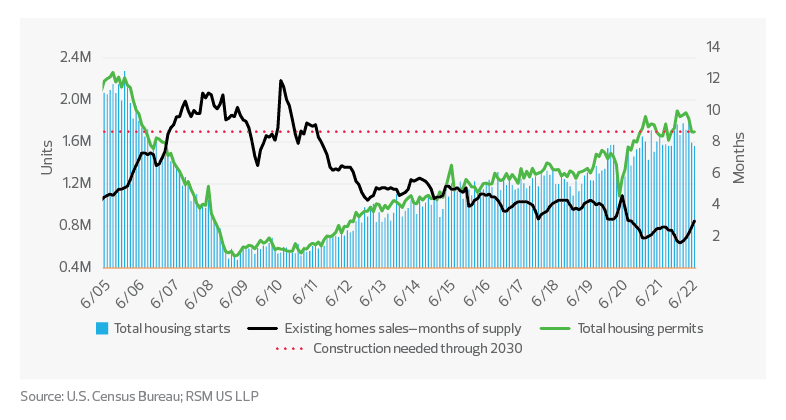

The need for more housing in the United States is apparent. We estimate the shortage was about 3.5 million units at the end of last year. More than a decade of underproduction that ensued with the Great Recession, followed by pandemic-induced supply chain woes and labor shortages, has kept new construction constrained. We estimate the United States will need to build approximately 1.7 million new houses annually between now and 2030 to close the housing gap.

U.S. housing starts and permits vs. months of supply

Despite the substantial need for housing, the cooling in demand has caused builders to slow construction activity. Housing permits and starts were down to annualized rates of 1.67 million and 1.45 million, respectively, in July, compared to 1.84 and 1.67 million at the beginning of this year, according to the U.S. Census Bureau. While we do not expect to see construction come to a standstill, it is likely to continue falling, as builders become more cautious about managing their inventory levels. This will further exacerbate the housing shortage.

Adjusting to market conditions

Over the past year and a half, builders have struggled to produce enough homes to meet record demand. Pandemic-induced challenges, including a lack of skilled labor and higher costs for materials ranging from lumber to steel, have led builders to adopt more nimble strategies to manage their margins. These include metering sales to match production capacity or delaying sales to later in the construction cycle. As demand has cooled, builders must again pivot to changing market conditions.

Stuart Miller, CEO of homebuilder Lennar, captured the need for this flexibility during the company’s June 21 earnings call. “Whether the market is improving or declining, we deploy our dynamic pricing model week by week to price products to current market conditions,” Miller said, adding, “We maintain a carefully limited inventory level.”

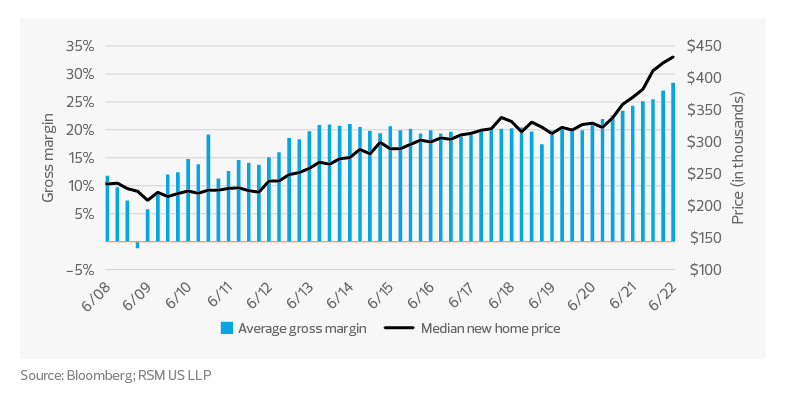

Buyer incentives such as rate buy downs and closing discounts, which were largely nonexistent over the last year, have been more widely embraced by builders in recent months as they work to push inventory and help offset affordability constraints in the softer housing market. Despite the use of incentives, margins remained largely unaffected during the second quarter, as builders continued to work on backlogs. As demand moves to more normalized levels, we expect to see greater use of incentives and price cuts, particularly in markets where construction ramped up more quickly and inventory has risen to more balanced levels.

Meanwhile, as existing homeowners sit tight and opt to maintain their locked-in lower mortgage rates, resale inventory will likely remain limited. We expect a wave of new-home inventory coming into the market, as unsold homes resulting from builders delaying sales to later stages of construction are completed. Builders’ need to push inventory through price cuts and incentives will eat into their margins, partially offset by lower lumber prices in the second half of the year. But the erosion of margins to more normalized levels should not present a problem for builders, as they have benefited from record margins over the last two years.

Home builder peer group average gross margins vs. new home price

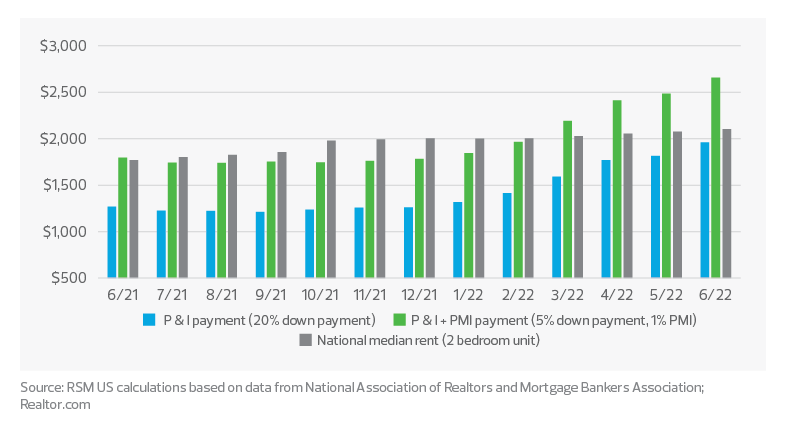

The rental market

The housing affordability crisis in the United States is creating a dynamic shift away from homeownership toward renting. While rents are rising, mortgages are up even more. In 2022 alone, monthly mortgage payments have increased nearly 50% on average from the beginning of the year to June, while the national median rent is up 5% for the same period, making it more affordable for many to rent. With the formation of new households continuing to rise and an ongoing structural shortage in housing in the United States, Americans will still need a place to live and will continue to turn to rental properties.

Monthly rent vs. monthly payment, median priced home, 30-year mortgage

Over the last year, homebuilders, including Lennar and D.R. Horton, strategically expanded their build-to-rent operations to diversify income streams and mitigate risk. Single-family build-to-rent communities provide an option for individuals and families who may be saving money for a down payment, or who are not ready to be tied down to a longer-term purchase but still want to experience a single-family neighborhood. As affordability constraints continue, and more Americans turn to single-family rentals, we expect to see a ramp-up in build-to-rent operations, with other builders diversifying into this growth segment.

Strategies for builders

The second half of the year will prove less favorable for builders, as housing adjusts to a more balanced market. When looking to maximize returns and manage their capital, builders can implement the following strategies:

Monitor conditions for each market in which they operate, to evaluate key metrics and rebalance pricing and incentives as needed.

Diversify operations to provide more affordable housing options for Americans, including rentals and modular homes.

Invest in technology to modernize operations and produce homes more efficiently and at lower costs.

The takeaway

While housing has cooled from the frenzy of the last two years, the sector has a solid foundation and will continue to provide opportunities for builders while creating much-needed shelter for Americans.