Business travel, while recovering, has suffered amid pandemic restrictions.

Key takeaways

Rising room rates nationwide are a worrisome trend consumers are watching.

Labor presents significant challenges to hospitality, and new incentives are important.

As the pandemic appears to be moving into the endemic phase, corporate leaders are asking tough questions about business travel: When is it safe to get teams back on the road? Which planned in-person events can become virtual going forward? Does the growing focus on environmental, social and governance issues mean responsible corporations should reduce their travel footprints? Meanwhile, leisure customers weary of intermittent lockdowns and other pandemic restrictions have resumed vacation travel, helping to keep hotel occupancy at healthy levels.

Business travel has suffered amid vaccine mandates and limited options for COVID-19 testing. Moody’s Analytics forecast in December that certain segments of business travel may never fully return to pre-pandemic levels; according to Moody’s report, permanent declines of 10% to 30% are expected as the forced adoption of virtual connectivity technologies replaces non-mission-critical in-person meetings.

STR, the CoStar hospitality analytics firm, said in a December article that business and group travel is running at 60% to 80% of pre-pandemic levels, and emphasized that a rebound in that space is essential to the sector’s recovery.

To be sure, bigger companies appear to be taking a wait-and-see approach to in-person meetings and events. On a November earnings call, Marriott executives said small and medium-size accounts were responsible for roughly 75% of bookings last year through the third quarter. We believe the volume of larger corporate events is not expected to reach 2019 pre-pandemic levels until at least 2023. Segments of hospitality more heavily reliant on large conventions, nearby attractions such as dining and entertainment, and office space will likely continue to lag in recovery.

Despite the downturn, business travel has shown encouraging signs since late 2021. The widespread availability of vaccines and therapeutics, as well as the November lifting of an international travel ban for companies doing business in the United States, has resulted in more certainty for companies booking travel. Hotels have been showing a slight pickup in weekday occupancies, with STR data showing a rise of two percentage points to 45.3% in mid-January, lending support to a nascent recovery in business travel.

In Marriott’s recent earnings commentary, CEO Anthony Capuano noted that “business transient demand picked up again in October, a trend we expect to continue.”

Leisure travel leads the rebound

Meanwhile, leisure travelers appear happy to be back on the road, encouraged by the milder-than-expected health impact of the omicron variant amid lower risk of serious infection and hospitalization, and by increased nationwide vaccination levels.

Customer throughput data from the Transportation Security Administration shows that late 2021 travel was nearing pre-pandemic volume, despite the worldwide surge in omicron infection; 20.6 million rooms were sold in the United States in the seven-day period between Christmas and New Year’s Eve, according to CoStar, a holiday-week record.

In a third-quarter earnings report, Mark S. Hoplamazian, CEO of Hyatt Hotels, said “leisure demand continues to lead the recovery”; the chain noted that by September leisure demand had nearly fully recovered.

As business, group and international segments begin to rebound, consumers now worry that room rates—which are holding strong for all segments—will surpass affordable levels, mirroring inflationary pressures. Hotel rates rose 26% year over year from November 2020, making room price increases the third-highest mover behind gasoline and rental cars.

“Things are going to come back faster than prior recoveries here,” Hilton CEO Christopher Nassetta said on the company’s October third-quarter earnings call. “Typically, it’s a grind to build back occupancy, and rate lags significantly. Rate is leading the charge here.”

The impact on hospitality

While management is focused largely on top-line revenue, labor is presenting significant challenges for the hospitality industry. In November, the Department of Labor reported that 4.5 million Americans quit their jobs, including 1 million in the accommodation sector; that’s 1 in 16 U.S. leisure and hospitality workers, or roughly 6% of the hospitality workforce. Even with a 13.6% rise in wages from February 2020 to November 2021, average hourly earnings of $19.20 make hospitality workers the lowest paid of all industries.

With the recent advent of new incentives and retention bonuses to attract workers to historically lower-paying jobs, the hospitality industry is getting a wake-up call. Workers’ shifting priorities, including an increasing emphasis on work-life balance, have elevated nonfinancial job benefits such as flexible schedules, a strong corporate culture and opportunities for career development. Hospitality will need to keep pace or risk seeing workers lured away.

Hotel recovery

So where does this leave hotels, with their longer path to recovery? The credit markets are encouraging; recent earnings releases and November data from the Federal Deposit Insurance Corporation show that losses on commercial real estate portfolios across all segments are at or near record lows for many lenders. This is in large part due to the assistance banks were offered by regulators early in the pandemic to adjust payment terms on loans; those obligations weren’t reported as troubled debt restructuring or impaired credit.

Additionally, most current hotel loans maturing in 2022 will not default, helped by the continued recovery of financial metrics toward pre-pandemic levels, ongoing patience demonstrated by bankers, and the plethora of cash that is targeting real estate investment, including rescue capital available to assist owners until their asset performance fully recovers.

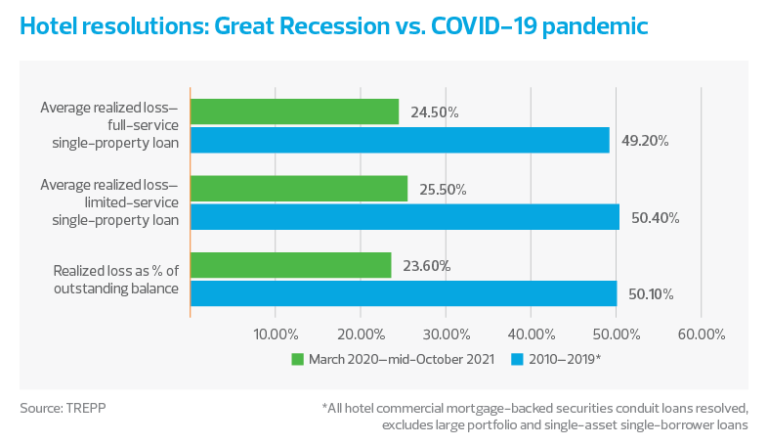

Comparing hospitality data following the Great Recession of 2007−2009 to recovery during the pandemic tells a clear story: It simply isn’t as bad this time around. An expected tsunami of distress never materialized, and funds that were raised to target distressed assets have seen meager investment pickings. Average realized loan losses over the recovery period of 2010 to 2019 were a staggering 50.1%—slightly higher for limited-service hotels and slightly lower for full-service hotels. The pandemic recovery period of March 2020 to mid-October 2021 shows losses of about half that rate (excluding loans that were delinquent prior to March 2020).

The value of recent transactions, including the sale of of several Four Seasons brand assets, illustrates that capital rates are consistent with 2019 levels, and signals that distressed sales will continue to be meager.

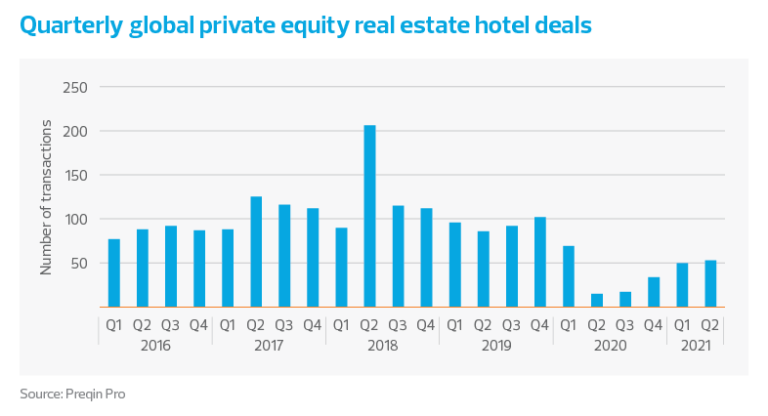

Additionally, transaction activity is finally picking up after a slowdown in 2020 due to the pandemic. Seventy-seven deals in the third quarter of 2021 showed a more than threefold increase from a year earlier, according to research firm Preqin Pro.

The takeaway

Even as the hospitality industry copes with challenges around revenue management, leaner operations and a fickle labor market, signs of recovery are showing. The leisure segment is holding up the industry, and the hope of a manageable omicron variant will spark the steady return of business, group and international travelers. The availability of debt and equity capital has never been better. Hotel assets provide an opportunity for investment funds to deploy record levels of dry powder lying dormant.

RSM contributors

Subscribe to Real Estate Insights

Stay in the know with our monthly digest of tax, accounting and business considerations for companies in the real estate industry.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.