The three areas that middle market life sciences companies should pay specific attention to are supply chains, labor and capital markets.

Key takeaways

We anticipate a decreased appetite from private investors to pay high company valuations, but an uptick in the number of life sciences startups.

An uptick in the number of life sciences startups presents an opportunity for strategic companies to expand their footprint and make acquisitions.

We start 2022 with continued uncertainty around the economy, geopolitics and the omicron wave of COVID-19. While these are persistent challenges that society and business face, the life sciences industry has proven resilient and achieved another record year of growth and innovation.

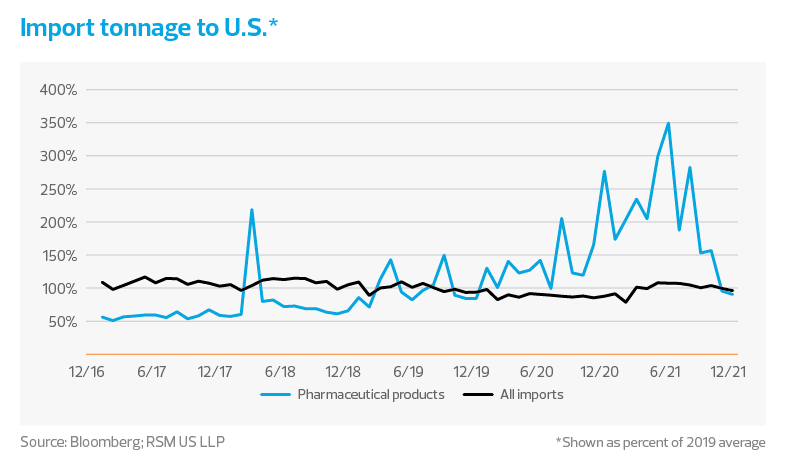

The twin policy shocks caused by the 2017−2020 trade war and the decision to effectively shut down elements of the global economy during the pandemic have resulted in an effective simulation of what deglobalization looks like.

For the life sciences ecosystem to continue to thrive, leaders must reevaluate their operating environment and plan for key drivers this year. The three areas that middle market companies should pay specific attention to are supply chains, labor and capital markets. These closely interrelated topics will shape 2022 and the future evolution of life sciences.

Supply chain: The most commonly cited concerns about the life sciences supply chain are dependence on foreign suppliers; a lack of resilience in domestic production; and that the discussion of reshoring and investing in U.S. capacity has been intensified by pandemic fears of drug shortages and rising prices. In reality the situation is much more complicated.

To break down the landscape to its most basic level, the majority of high-efficiency, low-cost production for the generic pharma and medtech sectors comes from overseas (and has not been disrupted because of its high value, high importance and low physical volume). For branded pharma and biotech the majority of production is highly specified, small batch, and located domestically or in Europe for reasons of technical difficulty and intellectual property protection. Domestically, from a capacity and resource perspective, life sciences companies have also been able to rely on rapidly expanding capabilities of specialty third parties that can support or take over key processes such as drug discovery, clinical trials, logistics and manufacturing.

Compared to retail, manufacturing and hospitality, life sciences companies have been relatively shielded from the disruption and cost of supply chain issues. Shipments from overseas have increased during the pandemic, the consumer price indexes for drugs and medical supplies decreased from pre-pandemic levels, and according to data tracked by the Food and Drug Administration there have not been significant changes in drug shortages or the number of products on watchlists. On the surface it may appear that disruption has been manageable, but the challenge for life sciences leaders in 2022 will be on managing thousands of slow leaks in the global supply chain that they don’t have control over. Shipments are still being delayed, prices are rising, labor is tight and investors have more options for investment as the economy rebounds.

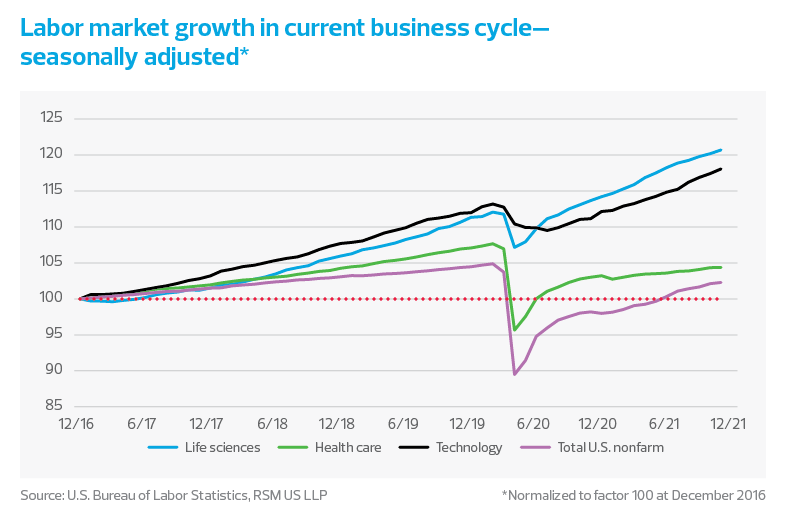

Human capital: While major disruption has been averted, spillover effects of chip shortages, port delays and rising prices more generally have contributed to margin compression for middle market companies. The larger and most mission-critical challenge for life sciences has been and will continue to be the development and retention of a highly skilled workforce.

The pandemic has accelerated the retirement of experienced baby boomers as well as women, who represent more than 60% of biology graduates and have left the workforce faster than any demographic. Likewise, the shift to remote and digitized work for a growing number of technological products and services companies has created a battle for STEM talent, further contributing to the volatile workforce environment. See our special report on changing work patterns for a deeper discussion on what the middle market is experiencing from a labor perspective.

Through 2021, life sciences recovered lost ground in terms of hiring, but the record-breaking levels of capital invested into the ecosystem spurred startups, business expansions and new research that continue to move the industry forward, while also creating competition among peers and non-life sciences sectors. It is also important for leaders to consider the labor and consumer markets on which they rely. If unemployment remains an issue and the health care industry is unable to serve a patient population, then life sciences will be negatively impacted. The most susceptible sectors are likely medtech, which is highly dependent on operations, diagnosis and patient services provided in health care settings; and drug developers, with clinical trials that struggle with recruitment and retention as pandemic effects linger.

This year will be a time for business leaders to consider investment in labor-enabling technologies that support workers to increase efficiency, create connectivity and eliminate wasted time and effort. This may also mean partnering with specialty life sciences services companies—i.e., contract research organizations (CROs), contract manufacturing organizations (CMOs), third-party logistics providers (3PLs), and outsourced finance and IT teams)—so that companies can focus on mission-critical objectives and leverage the skills and technology of third parties. Now is also the time to think about how business interfaces with investors, suppliers and consumers. Eliminating barriers, maximizing user experiences and creating a seamless digital experience will be paramount.

Life sciences has always been on the cutting edge of technology and innovation, but without the disruptions and cost increases seen by the rest of the economy, the ecosystem has not been forced to consider alternative business practices or the need to make additional investments in efficiency and capacity. For U.S. life sciences to stay ahead of its global peers and compete domestically for investment dollars and skilled labor, 2022 presents a unique opportunity intentionally and proactively. Diversification of suppliers and partners, investment in machinery and technology that allows for greater control and quality, and implementation of social and governance practices that attract and retain talent are considerations that life science companies should work into their 2022 and future strategies.

Change brings opportunity but also risk in terms of investment, disruption and temporary inefficiency. The question for life sciences leaders is how to manage disruption in the near term while achieving stability and profitability in the long run. While the pandemic may have provided a glimpse into deglobalization for the broader economy, it provided life sciences with a view as to what can be accomplished on a global scale in the development, approval and distribution of innovative products when there is collaboration among businesses leaders, policymakers, regulators, payers and providers. The test now will be to make the necessary social and monetary investments to re-create this success on a sustainable basis across the ecosystem.

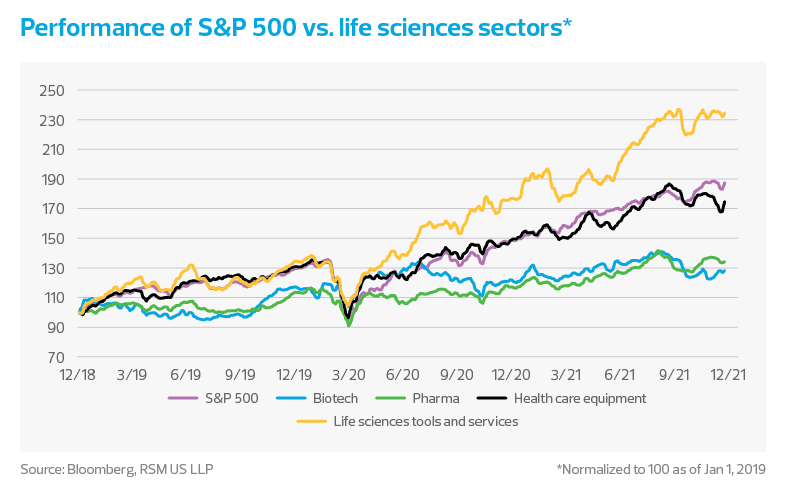

Capital markets: Pandemic challenges aside, 2021 was another record-breaking year for investment in life sciences. While capital inflows from private investors, public markets and corporate players provided an extra boost for innovation and business expansion, the performance of life sciences in the equity markets paints an interesting picture for the various sectors of the industry in 2022.

Life sciences tools and services, which include CROs, CMOs and many of the diagnostic and supporting services, continue to outpace all other life sciences sectors as well as the S&P 500. We expect volatility will continue to rise in 2022 as the market reacts to the ongoing labor and supply challenges. Additionally, macroeconomic uncertainty regarding inflation and COVID-19 challenges will continue to exacerbate the issue.

Except for the COVID-19 vaccine bump experienced by biotech in mid-2020, biotech and pharma have continued to underperform against their life sciences peers and the broader market over the last three years. These market returns should be viewed in context with other capital markets that paint a more complete picture of how the life sciences industry is evolving and what we expect to see in 2022. Medtech has been the most consistent and least volatile sector throughout the pandemic, despite supply chain challenges for major technical components and semiconductors, as well as pandemic-driven backlogs for many non-emergency implants and procedures. We anticipate that 2022 will see a level of consolidation within the industry as larger players capitalize on decreasing valuations, their access to capital, and their ability to purchase smaller companies that continue to struggle during the prolonged pandemic.

Biotech continues to be a focus for investors as advanced technologies and breakthrough techniques in cell, gene and immuno-oncology become more commonplace and financially viable. While the majority of prescription and drug spending remains with traditional pharmaceuticals, the shift to large-molecule biotechnology is well on its way. The decrease in hype around biotech following the pandemic has reduced expectations to a more reasonable level, but significant opportunity remains. We expect valuations to fall, but access to capital to remain high, and large pharma is likely going to increase its merger and acquisition activity with biotech targets to expand and diversify its pipelines.

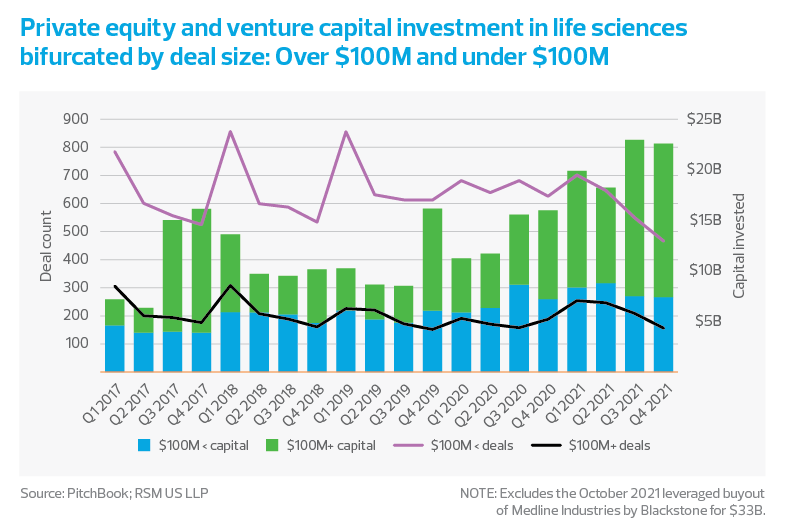

Private deal flow slows while valuations break records

The traditional first-quarter bump associated with the J.P. Morgan Healthcare Conference has flattened over the last couple of years. This began in 2020, prior to the shift toward a virtual conference—but the overall amount of activity has not changed. Therefore, investors likely have simply begun finding better ways to identify and close deals. We expect this trend to continue and will confirm the 2022 first-quarter results in our next industry outlook publication.

Total capital raised in deals under $100 million has remained consistent with long-term trends, while the number of transactions over $100 million has grown through the pandemic. The valuations for these larger deals are also increasing, as evidenced by the smaller number of deals but increasing total invested capital. Capital and valuations had a breakout year in 2021, which saw more than double the amount of capital invested in the years 2017 to 2020. That said, quarter-over-quarter activity showed a noticeable decline in the number and value of private equity and venture capital deals, following a trend seen in the public market space.

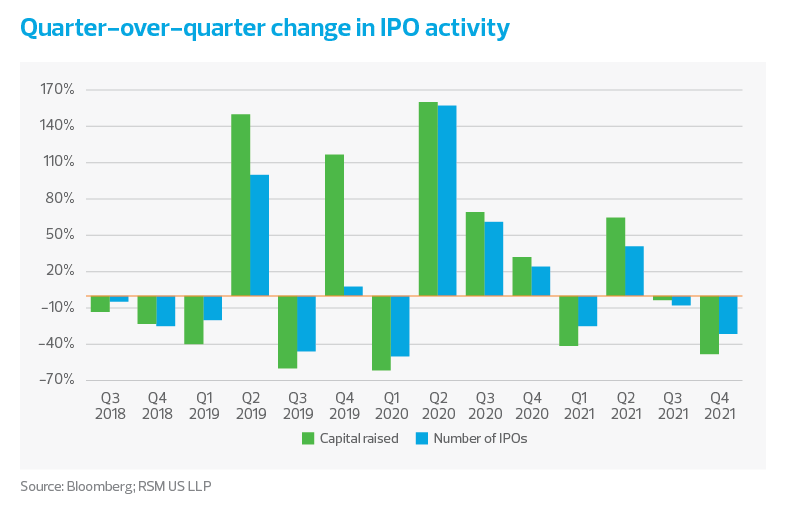

Velocity of IPO activity begins to decline

Typically, the proportion of investment dollars follows initial public offering (IPO) activity. That trend continued in 2021 with another record-breaking year for IPO capital raised. Notably, biotech remains the dominant sector in the life sciences IPO space, representing roughly 75% of all life sciences IPOs, deals and capital raised over the last two years.

However, we’ve seen a slowdown in the velocity of public market activity, especially in the latter portion of 2021. This is expected to continue as the broader U.S. and global markets recover and investors seek expanded options for returns. In 2022, we expect moderation of the IPO markets, but continued dominance of the biotech sector.

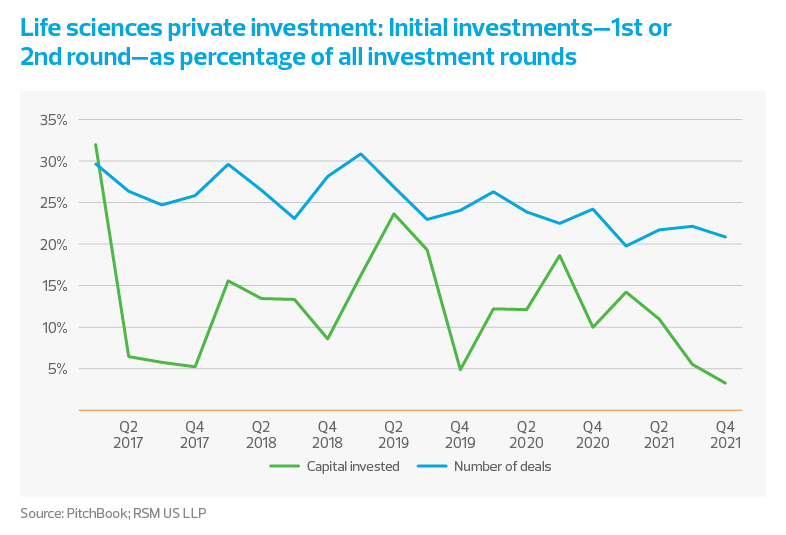

Startup interest continues to decline

The proportion of initial investments, which approximates investor interest in startups, has declined during the pandemic. In 2020, we saw a 10% decrease in the number of initial investments from the pre-pandemic (2017−2019) annual average, with 2021 experiencing an even larger decrease, of 25%. The number of subsequent financings has remained consistent during the pandemic. The amount of capital flowing into each of these cohorts has grown significantly, with initial investments in 2021 increasing 42% over the pre-pandemic average, and subsequent investments increasing by 145%. This activity is consistent with the trend we’re seeing, in which life sciences companies stay private longer as opposed to looking for a buyout or opt to raise additional capital to pursue increasingly difficult and expensive technologies. Given the strong IPO market for life sciences companies over the last few years, many private investors have been willing to invest more capital and for a longer duration to take advantage of the historically high public valuations.

As the apparent market risk of the pandemic and the associated global slowdown ease into this year, we anticipate a decreased appetite from private investors to pay high company valuations, but an uptick in the number of life sciences startups. This presents an opportunity for strategic companies that outperformed during the pandemic to expand their footprint and make acquisitions, leveraging their stockpile of capital. In the medtech sector, companies will look to capitalize on smaller companies that continue to struggle during the pandemic. We may also see them expand into sectors that leverage new technologies, including integrated software as a service (SaaS) platforms, and that have a drug and device component, such as insulin pumps in conjunction with diagnostics and testing.

RSM contributors

Subscribe to Life Sciences Insights

Knowledge is power. Stay up to date with key life sciences trends and timely insights, delivered straight to your inbox.

The Real Economy

Monthly economic report

A monthly economic report for middle market business leaders.

Industry outlooks

Industry-specific quarterly insights for the middle market.