Affordability remains a top concern for the housing market, but there is a strong need for new homes.

Key takeaways

Builders are cautiously optimistic as they closely monitor market conditions.

Technology and automation solutions may help builders increase productivity and reduce costs.

After a drastic shift in the second half of 2022, the housing market started with a strong foothold in 2023 once builder sentiment rose following reports of an early spring selling season and stronger-than-expected sales.

The outsize impact of interest rates

Last year, mortgage rates climbed much more rapidly than expected, reaching nearly 7.5% in September after starting the year below 3.5%. The rapid rise in mortgage rates led to a substantial slowdown in demand, as potential homebuyers could no longer afford monthly mortgage payments.

This increase caused many to rethink their buying decisions and created housing affordability issues across the United States.

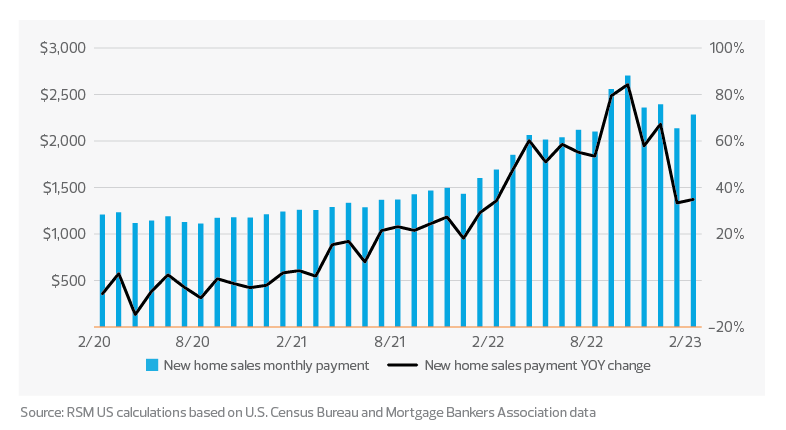

Affordability remains a top concern for the housing market as monthly mortgage payments (assuming a 20% down payment) are up 38% from a year ago for a median-priced new home and 40% for a median-priced existing home. Despite these increases, pent-up demand, the use of builder incentives and some easing in mortgage rates have brought some consumers back to the market.

U.S. housing affordability

This market change was evident in January as mortgage rates fell to the low 6s, spurring activity; however, the volatility in mortgage rates has since continued. In February and early March, rates rose once again as new macroeconomic data, including a better-than-expected jobs report and a surge in inflation, pointed to an overheated economy and additional action needed by the Federal Reserve to hit its inflation target of 2%.

Recently,10-year treasury yields and mortgage rates have eased. This easing signals the market is expecting further disinflation, following a hike of 25 basis points by the Fed and Chair Powell’s announcements, which indicated that the recent shocks in the financial sector are “likely to result in tighter conditions that weigh on economic activity, hiring and inflation.” As a result, mortgage rates fell from recent highs of more than 7% to below 6.5% at the end of March.

Rising interest rates have been a major headwind for builders and consumers alike, with many potential buyers priced out of the market. The composite homebuyer affordability index stood at 95.5 in the last quarter of 2022, down from 142.8 a year earlier. The first-time homebuyer affordability index was 63.3 during the last quarter of 2022, down from 94, according to the National Association of Realtors. These indices measure the ability of a family with a median income to afford a median-priced home, assuming a 20% down payment (10% for first-time buyers); a value of 100 indicates just enough income and anything below it indicates insufficient income.

While aspiring buyers are out there, historically high mortgage rates have pushed many to the sidelines. Recent retreats in mortgage rates will help provide relief to potential buyers bringing pent-up demand, which is already creating a quick response, as mortgage applications were up every week in March, according to data from the Mortgage Bankers Association.

Builders to proceed with caution

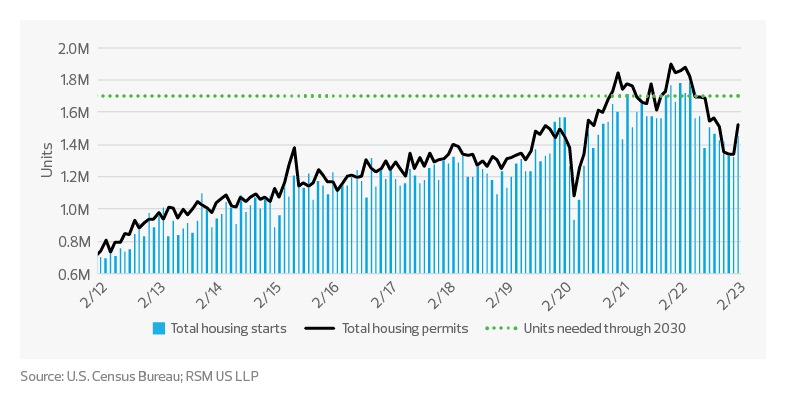

In March, housing permits and starts were at 1.41 and 1.42 million annualized units, respectively, above recent lows but still down from 1.88 and 1.72 million from the prior year. During the same period, single-family permits and starts were at 818,000 and 861,000 annualized units, respectively, down from 1.16 and 1.19 million a year prior.

The current U.S. housing shortage is estimated to exceed 3.5 million units; approximately 1.7 million new homes will need to be built every year through 2030 to close this housing gap.

Recent improvements to builder sentiment, resulting from a better-than-expected start to the spring season and the recent easing of mortgage rates, are expected to spur much-needed single-family housing construction activity in 2023. Although many builders remain cautious in the near term amid the instability in the banking system and monetary tightening, which could result in constraints for acquisition, development and construction loans for builders as well as make it more difficult for some mortgage borrowers to secure credit.

New housing construction

A shift in the composition of housing inventory creates opportunities

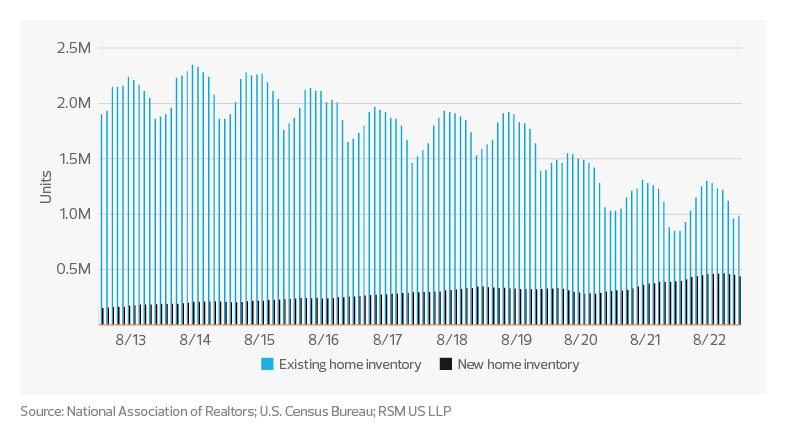

Even as new construction of homes has declined, the lack of existing inventory has created a significant shift in the composition of units available for sale favoring new builds. In February, new homes accounted for 436,000 units or 31% of total housing inventory, a substantial increase from pre-pandemic levels when new units available for sale generally comprised approximately 10%-15% of total inventory.

The shift toward new builds is a direct result of the mortgage “lock-in effect,” as over 90% of homeowners were estimated to have mortgage rates below current rates, as of August 2022, according to data from CoreLogic. This phenomenon has caused reluctance among current homeowners to sell their homes, limiting the resale inventory. We expect this trend will represent a more permanent shift in housing, as mortgage rates are unlikely to return to the historical lows of the pandemic period, and homeowners are less likely to trade their current mortgages for those with much higher rates.

Housing units available for sale

The housing shortage combined with demographic shifts, including the millennial generation being at the prime homebuying age, along with a shift in the composition of existing and new homes, create a very favorable long-term outlook for residential construction. In the near term, however, mortgage rates will continue to drive much of the demand. Many buyers remain on the sidelines, and while we will see a cautious return of the housing market until mortgage rates reach a more stable terminal rate, demand for housing may not fully return.

In the meantime, residential builders need to take proactive steps. These steps include having a firm handle on their costs and key financial metrics to allow for optimal pricing models and home production. They need to closely monitor market conditions for each market in which they operate or wish to operate and invest in technology and automation to increase productivity and reduce costs.