ACA standards for health coverage

If a large employer wants to avoid the “pay or play” penalty, it must offer employee health coverage that meets three ACA requirements: (1) minimum essential coverage, (2) minimum value and (3) affordability.

Minimum essential coverage. First, the ACA requires that the employer offer minimum essential coverage to at least 95 percent of its full-time employees and their dependents. Most insured or self-insured group health plans will constitute minimum essential coverage. The coverage must be offered to 95 percent of employees working, on average, at least 30 hours per week and their children up to age 26. Part-time employees working less than 30 hours per week are not required to be offered coverage. Interestingly, spouses are not considered dependents for this purpose; therefore, employers are not required to offer coverage to spouses in order to avoid the penalty.

If a large employer fails to meet the minimum essential coverage requirement, it could be assessed a penalty equal to the number of its full-time employees for the year (minus up to 30 employees) times $2,000 if at least one full-time employee purchases health coverage with premium tax credits through the Health Insurance Marketplace (also known as the exchange). No penalty is imposed for failing to offer coverage to part-time employees working less than 30 hours per week. This nondeductible penalty is imposed by month and is indexed for inflation. The penalty is $2,970 ($247.50 per month) for 2024.

Example: Company X offers a group health plan to its 280 full-time employees working in Arizona but does not offer coverage to its 20 full-time employees or five part-time employees working in other states. One full-time employee purchases health coverage through the Marketplace with premium tax credits. Since Company X is offering health coverage to only 93 percent (280/300) of its full-time employees, it does not meet the 95 percent threshold and could face a nondeductible penalty for 2024 of $801,900 ((300 full-time employees – 30 employees) x $2,970).

Employers in an aggregated group are considered separately for penalty purposes. However, the 30-employee exclusion is prorated among the companies in the group based on the respective numbers of full-time employees. Each company is responsible for maintaining a health plan that meets ACA standards or paying a penalty based on its workforce. One company’s failure to maintain an ACA-compliant health plan does not trigger penalties for the other companies in the aggregated group.

Minimum value. Second, the ACA requires that health coverage meet a minimum value requirement. A health plan meets the minimum value requirement if it covers certain types of medical expenses and is designed to pay at least 60 percent of employees’ health care costs, with employees picking up the remaining 40 percent through deductibles and copays. An employer can determine if this minimum value standard is met by reviewing its Summary of Benefits and Coverage document or asking its health insurance carrier or third-party administrator. Alternatively, an employer can determine the value itself using a calculator created by the government or could engage an actuary to determine the value. Since an employer is required to certify on Form 1095-C whether its health plan meets the minimum value standard, it is important that every large employer have written documentation supporting the plan’s minimum value.

Affordability. Third, the ACA requires each health plan to meet an affordability standard, which limits the amount an employer can charge an employee for self-only coverage. There is no limit on the amount an employer can charge for other levels of coverage, such as family coverage. To be affordable, the employee’s cost for self-only coverage cannot exceed 9.5 percent of one of the following safe harbors: (1) the employee’s wages in box 1 of Form W-2, (2) the employee’s rate of pay, or (3) the federal poverty level. This percentage is indexed for inflation and is 8.39 percent for 2024.

Failure to meet either the minimum value or the affordability requirement could subject an employer to a nondeductible $3,000 annual penalty for each full-time employee who purchases health insurance coverage through the Marketplace with premium tax credits. This penalty is adjusted annually for inflation and is $4,460 ($372.00 per month) for 2024. For example, if an employer offers a health plan to its 300 full-time employees that does not meet the minimum value standard and 12 of those employees purchase coverage through the Marketplace with premium tax credits, the employer’s penalty would be $53,520 (12 full-time employees x $4,460).

Paying the penalty

Large employers that do not have ACA-compliant health coverage will owe a penalty if any of their full-time employees report a premium tax credit on their individual income tax returns for health insurance they purchased through the Marketplace. Employers are not required to calculate the employer shared responsibility payment on any tax return that they file. Instead, the IRS will mail them a notice of their proposed ESRP penalty assessment tax liability and give them an opportunity to respond before a demand for payment is made.

The IRS will determine if an employer owes an employer shared responsibility payment based on information obtained from Forms 1095-C and 1094-C and employees’ Forms 1040. If the IRS determines that a payment is owed, it will mail the employer Letter 226J detailing the penalty amount by month. Employers have 30 days to respond, and can either pay the penalty or send the IRS an explanation of why it does not agree with the assessment.

The IRS will acknowledge the employer’s response via Letter 227. If the employer still disagrees with any proposed employer shared responsibility payment, it can request a pre-assessment conference with the IRS Office of Appeals. Following this step, if the IRS determines that the employer owes the employer shared responsibility payment, it will issue a notice and demand for payment (Notice CP 220J). Employers that fail to respond to either Letter 226J or Letter 227 will also be issued a notice and demand for payment. Employers making employer shared responsibility payments to the IRS will not be able to deduct them on their tax returns.

Employers can reduce their exposure for penalties by ensuring that the IRS has accurate information about their plans via the Marketplace and Forms 1095-C and 1094-C.

Health Insurance Marketplace. In some states, when employees enroll in Marketplace coverage, they are asked whether they are offered ACA-compliant health coverage by their employers. The Marketplace will mail the employer a notice indicating that a given employee is eligible for premium tax credits for health insurance and that the employer may be subject to a penalty for not offering the employee ACA-compliant coverage. The notice will contain details about how the employer can appeal the premium tax credit determination. Marketplace notices are separate and independent from the IRS Letters 226J and 227 so different appeal processes apply. An employer has 90 days to respond and can include evidence in the appeal that it did offer the employee ACA-compliant health coverage. An appeal judge may request a hearing or additional documentation prior to making a decision on the appeal. Large employers are advised to respond promptly to Marketplace notices to correct any misinformation the Marketplace has about an employee’s coverage.

Forms 1095-C and 1094-C. For 2015 and later years, large employers are required to file Forms 1095-C and 1094-C with the IRS to report whether an ACA-compliant health plan was offered to all full-time employees. The forms are complex and an error on the forms could provide inaccurate information about the employer’s workforce or health plans to the IRS, thus triggering a penalty. Employers are encouraged to use care when preparing the forms and to file corrected forms if needed. For more information about Forms 1095-C and 1094-C, see our article entitled Information reporting requirements under the Affordable Care Act.

Action required

To address the shared responsibility payment rules, employers should take the following actions:

- Learn more about the rules through the resources available on the ACA Information Center for Applicable Large Employers (ALEs)

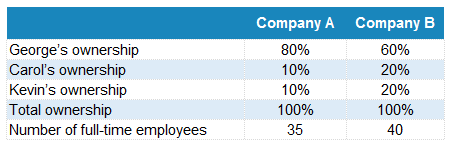

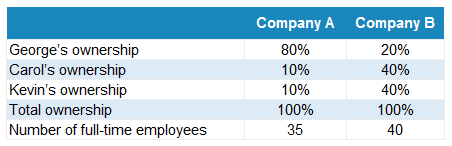

- Review ownership structures and perform an annual aggregated group analysis to determine which companies are in an aggregated group

- Identify each large employer based on employee counts in the prior calendar year

- Determine and document each employee’s full-time or part-time status by month based on ACA criteria

- Determine if the health plan meets the minimum essential coverage, minimum value and affordability standards, and consider any needed health plan design changes

- Understand the potential penalty exposure if the health plan is not ACA-compliant

- File accurate Forms 1095-C and 1094-C

- Respond to Health Insurance Marketplace notices as needed

- Respond promptly to the IRS upon receipt of a Letter 226J and visit Understanding your Letter 226-J for more information